Contributors to this thread:

OK the Senate Republicans got their tax plan through. Now the House and Senate have to work out their differences. Senate through out the requirement that we have to purchase insurance. Sounds like we will possibly lose our deductions for mortgage interest, state income or sales tax deductions. Off set by increased personal deductions. What are the thoughts of these tax plans.

I do not think that state and local taxes or mortgage interest should be deductible.

Making them deductible just subsidizes high taxes in leftist states.

I’m waiting for the “yeah but the rich are getting the biggest cut”. Well when the top 20% contribute 2/3 of the tax revenues they are going to get a bigger cut.

Business taxes need more than reduction, they need to be eliminated, as business doesn't pay them anyway, we the consumer do.

And that ****ing Obama health care tax better GONE too!!!

I agree with Henry and Kevin. Actually, at my age, I shouldn't even have to pay taxes but then, that's another debate. There is a possibility that the House could just vote on the Senate bill and save a lot of time.

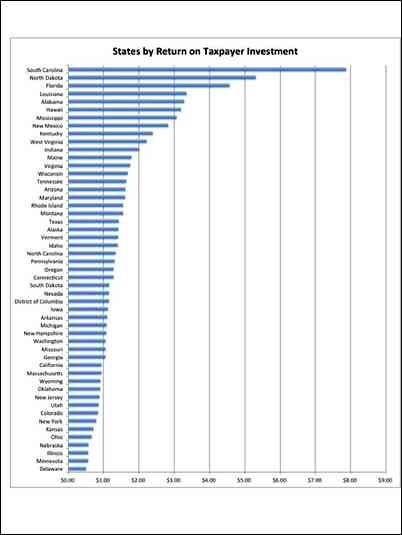

Solo, the facts don't back that up. There are 14 States that are "givers" at the Federal level. They pay more in taxes than they get back from the Federal government. Based on the results of the last election, Trump carried 30 States and HRC carried 20 States. Of the States that Trump carried, 6 are Federal givers (20%). Of the States that HRC carried, 8 are givers (40%). So if anyone is getting more out of the taxpayer base, it's the red states -- blue states tend to subsidize red states, not the other way around.

I think the increased standard deduction will offset the loss of SALT in places, and some people will end up paying more, some people will end up paying less. The consensus from the economists seems to be that it will have a negligible effect on GDP (see attached link). Investors could be big winners -- companies seem to favor returning money to shareholders instead of deploying excess capital to growing their business lately so we might not see much in the way of jobs but the stock market could benefit greatly. The consensus is that it will add to the deficit, which I don't worry too much about.

As a rather high income wage earner, as much as I'd like a tax break, I don't need it and I hope it ends up being that the breaks go more to the low- and middle- income wage earners. This is tough to do when the top wage earners pay a disproportionate amount of tax in this country. Time will tell.

Trump has admitted to gaming the tax system. He’s set to make billions on this tax deal. He’s no hero of the middle class when this plan clearly raises taxes on the middle class. No more deductions for student loans? No more deductions for teachers that purchase supplies on their own? No more deductions for fireman that supply the firehouse w food for their brothers? How is this ok? My cousin is a nurse. Under the Republican tax plan, she would pay a HIGHER tax rate than General Motors.

General Motors has $21 BILLION in savings.

My cousin has $1,500.

Corporations have more cash on hand than at any other time in US history. $1.9 TRILLION to be exact.

They ARE NOT spending it on jobs. Giving them more cash does NOTHING but make them richer by rewarding more bonuses, buying back stock to artificially pump up the values. Jobs are created by demand. Who provides that demand, consumers like the middle class.

"Trump has admitted to gaming the tax system. "

No, Trump has admitted to using the same loopholes provided by prebious administrations; just like you and I use. Why wouldn't you take advantage of them?

It’s a myth that corporations tie their taxes to consumer pricing. What wa the tax rate during Eisenhower’s administration? Much higher than now. What wa the Corp tax rate during Clinton years. Much higher than now. And prices of consumer goods weren’t affected. It’s a cheap excuse w no merit or truth to it. Consumer demand is what creates a booming economy. Consumers increase demand when they have extra money in their paychecks. Simple economics. Trickle down has never ever worked. Ever.

Job growth isn’t determined by federal tax breaks. Jobs are created in direct relation to demand & profits. If there’s a demand it causes company growth. If there’re isn’t a demand or profit no corps will assume overhead costs in excess of profit or demand.

I am extremely happy with the current version from what I understand of it-it would be great to end up with 20% instead of 25% for a pass-through business owner rate, but hey, 25% is a lot better than 39%. As far as corporations not paying taxes, I would strongly disagree with that statement, but I do think the adjusted tax rate is small for very large corporations and varies for others depending on their tolerance for audit risk. I do worry very much about the effect on the deficit, and the big three spenders are: Military, Social Security and Medicare/Medicaid-Trax, are those the entitlements you are talking about cutting? One or all of those will have to be cut to make any significant move towards balancing our budget, even with increased tax revenue through economic growth (although I don't own a crystal ball). Responding to posts above, I believe Big Easy Gator is correct on the state +/- tax takers/givers analysis, and so it will be interesting to see how the giving states react to this next election, even though the majority are traditionally blue.

A final comment: Why do you guys start out a statement with "dumb, blind sheep, idiot etc. LIBERAL," and then continue your thought? I assume you know you are immediately alienating some of the readers and so even in the slight chance you have a point to make it becomes lost. It's weak, little, and shows a lot about who and what you are IMO. If you have a point with substance to make, make it. We get it-you hate Hillary and Liberals.

Kelly

Sorry, Bownarrow, the term "you guys" is incorrect. It would be correct to say that a few guys do as you claim. And, frankly, some people are just crap throwing monkeys, "Atheist" being the latest rendition of a habitual one.

Atheist: My argument is that 1) I am better suited and more efficient in allocating my dollars to the economy (based on my purchase decisions) than the government is. The government is bulky and inefficient and eats up too much money in administration before finally using my dollars for the intended end-recipients (for example, a large portion of money is eaten up in government salaries instead of going to improve schools or clean up waste sites) 2) The people who make the money should enjoy the fruits of their labor. I'm not saying I shouldn't have to pay taxes, but is it fair for me to pay $100,000, 250,000, 1M in taxes while others pay little or none? 3) Finally, I do think that job growth will be positively impacted by this plan. My company will likely hire another sales person or recruiter, or maybe two, or we will be able to give out more raises or bonuses. To your point, those hires will be in direct effort to increase demand, gain market-share, and or keep our people happy.

And a final point to you so that all people on the board hate me equally. I'm sure you are aware but the fact that your screen name being "Atheist" detracts from your points-some folks can't get past that. It's your business, but just a thought that something less provocative would help people to read your arguments without prejudice. (I can hear you telling me to f-off so no need to say it out loud; ).

You have to create a favorable Corporate tax rate, to bring Industry and jobs into this Country. This cut will make us competitive in the World Market. I remember Obama chiding Trump for saying he would bring businesses and jobs into this Country, saying "how's he going to do that"? Trump said "hold my beer, and watch this" !

Kelly,

While I laud any attempt at honest engagement, the "Lyin King of Norwalk, CT" (aka Atheist, Ryan from Boone and about 37 other fake names) is a Quixotic quest at best; in all iterations the intent has never been honest engagement but provocation, period.

As a rule when anyone wants to argue present day tax rates and trots out 1950's rates they display a level of ignorance so great as to defy belief; post-WWII the US was the dominant player in the global economy; higher taxes were easier to absorb given the lack of global competition. Any honest person with an IQ slightly north of a pretzel knows this (hence my reference to the fruitless attempts at honest engagement).

Ditto for references to trickle-down economics, a phrase coined by liberals to ridicule Reagonomics and one never uttered by any fiscal conservative. The truth of the matter, in a fitting example of irony, is that trickle-down economics is pretty much Keynsian economics; again, anyone with even Forrest Grump's IQ should know this.

I agree with your assessment of this tax plan; the benefits outweigh the negatives by a healthy margin.

Do not suffer fools, ignore them.

This is a start. My wish is that there would be one tax rate (10%) for EVERYONE. No deductions. Then get to work and slash spending!

Henry:

"I do not think that state and local taxes or mortgage interest should be deductible. Making them deductible just subsidizes high taxes in leftist states."

Correct!! Absolutely agree 100%.

Chart of Federal dollar received for every dollar of Federal tax paid.

Chart of Federal dollar received for every dollar of Federal tax paid.

Curious, how have they been stealing from the Federal government when the big blue states (CA, NY, IL, NJ, MA) are all net givers to the rest of the country. They get back less from the Federal government than they pay into it. Those States are subsidizing the rest of the country at a Federal level, even with the Federal deductions that they get for high local taxes. If I were a resident of those States I would be pissed with the loss of deductibility of SALT. As it is, I live in Louisiana (red state). We get almost $3.50 back for every $1.00 we pay in Federal taxes -- so I'm good. But I at least understand the situation. The statement that "they've been stealing from the federal taxpayers the whole time, and getting away with it" is just false. Sorry, but it is. You might think it was those blue states, packed with damn hippie socialist liberals, sipping their lattes and providing free abortions for bored, horny teenagers are an economic drain on the rest of the country, but you'd be wrong. The biggest welfare states vote red. Yes, that's right. Red States are a net drain on the economy, sticking the blue states with the bill.

And NM, a blue state, ranks up there pretty high with LA as far as receiving fed dollars. Also UT, a red state, is at the bottom with your big blue state givers.

Something that shows a states economy ("GDP") relative to federal aid received would shed more light on it.

Your assumption that blue gives and red takes seems to be incorrect, State politics would have little to do with it (unless you throw some demographics into it) but more with what they make. UT is substantially smaller than NY, yet economically are "equal"...?

Anytime I see "return on investment" regarding taxes paid, I have to work hard to not throw up. Taxes paid are not an investment.

This is like the stupid car commercials telling you to invest in a new Lexus.

No, I’m not comparing apples to oranges, Solo. The “stealing” of federal tax dollars by liberal states that you proclaimed is an absolute falsehood. I don’t think you understand how this works.

I never said it was an investment, bk. I’m addressing the lie that blue states are the welfare states. The states with the highest SALT burden are also the ones funding the rest of the country at a federal level.

You might have more credibility if you'd compare welfare spending per capita, rather than the crap you posted. Western states have higher expenditures for things like highways. Air Force bases are concentrated in southern states, because the old t-38 trainers did not fly well in icy conditions. Southeastern states have had hurricane mitigation, etc. You are indeed comparing apples and oranges.

"Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort--thereby aborting our recoveries and stifling our national growth rate." "A tax cut means higher family income and higher business profits and a balanced federal budget. Every tax payer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education and investment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the federal government will ultimately end up with more revenues."

Step 2, after the tax bill passes, is a dramatic reduction in federal spending. Including, the entitlement programs that are on autopilot. Knocking the entitlement expenditures down by 25% would dramatically improve the economy.

An avg car payment will be $300. The savings they project will only make payments from Jan thru April, maybe May...

The per capita welfare story is more or less identical. The states with high per capita welfare tend to have lower tax collections and a higher percentage of low income citizens as part of their population. Places like NY and CA, while they have a lot of people on welfare, they have large populations and are relatively rich. The federal government spends a whopping $4.6 bln per year on the Army Corps (which only a part of goes towards hurricane mitigation) - nowhere near enough to skew the data above. Yes, military spending accounts for some of that (like South Carolina), but there is also significant military spending in CA and it is still a net giver. The point is if NY and California and all the other blue states decided to secede, there would not be a net influx of dollars at the federal level associated with the money being “stolen” by liberal states for liberal programs. The fact of the matter is the rest of the country would feel a whole lot of financial pain.

Solo, you’re arguing one of two points, neither of which I agree with.

1) liberal states “steal” federal dollars to fund liberal programs. If two people pay $50 each into a pot, and one takes out $75, I wouldn’t say the other guy left with $25 was stealing.

2) liberal states aren’t paying their fair share because they get to deduct their higher SALT. That would mean you’re arguing for, all else being equal, a larger federal government. No thank you.

Since I’ve been of legal voting age in 97, I voted for Bush (x2), McCain, Romney, and in the last election, Gary Johnson. I changed my voter registration from Republican to Libertarian in this last election as the Libertarian party reflects a better (not perfect) reflection of my political views than either of the mainstream parties.

My quote I posted was from JFK in 1963.

"It’s a myth that corporations tie their taxes to consumer pricing."

BULLSHIT! X1000. I HAVE a corporation, and I've been doing it for 40 years. It's an EXPENSE that you incur to produce your good/service. If you don't add it to the production cost then you're an idiot, and very soon an unemployed/bankrupt idiot.

^^^ absolutely. Anyone with any business sense knows that the price point is always a direct reflection of the operating cost. ALL of them.

"Anyone with any business sense......." Well that excludes most all career politicians, higher level academia, and a good chunk of the Democrat base. Obama was a CLASSIC example. He'd never had a real job no less run anything even as basic as a lemonade stand......and it showed.

Data doesn’t back that up either, Solo. When all government spending is accounted for, its a pretty mixed bag with regards to where the most government spending is. Yet another myth.

Microsoft sold windows for less than half of what they could command for it based on the competition. They wanted to build market share and dominate the PC business . Which of course they have. Amazon is doing the same thing in many categories and Is actually losing money in online movies and data. What I am hearing for investors is they may do the same thing with groceries and have probably already started.

Lots of business cannot raise prices and are forced by competitive pressure to cut prices and try to make it up through cuts and or efficiencies.

The data is inconclusive to your point as the dynamics vary as pointed out in the consolidated footnotes . There is no pattern. You get some states that are degenerativly blue intermixed with some red states that also happen to have large reservation populations/needs along with other wellfare requirements (again, degenerativly blue in concept).

The short of it is, each state recieves what their budget offices say they need based on their economic output which translates into income.

Some excellent points from both sides. Question, if they pass this before Christmas, when does it go into effect. 2017 tax season or with the 2018 taxes. I have 4 months until medicare, I paid $1,250 a month for health insurance. I have several medications for asthma, Diabetes. My Co - pay for drugs was over twice as much as cash price. So, we have easily over $28,000 in medical, that I am planning on using. Two months no insurance this year, 3 months next year.

Won’t go into effect until 2018.

so when are we going to pay off the national debt. where is that tax and spending cut policy?