After retirement how much hunting?

General Topic

I am just wondering with my retirement approaching in less than 3 years how much did your hunting increase?

Was it more often, did it stay the same, or did new obligations such as grandkids, elderly parents, etc. make it less time?

Did going to a reduced fixed income actually make it less time hunting?

Did you go on bigger hunts such as western hunts if you are a Midwesterner?

My bucket list of animals is really 2 that I have never hunted for before. One being Caribou and the other Mountain Lion.

I am fortunate to have a decent pension and I saved 10% of every check into a 401k. I always lived by the rule the first 6 minutes at minimum was for tomorrow the rest is for today! So I have a very decent 401 savings. Our home will be paid off in 2.5 years so really utilities and taxes will be our major expenses. Plus Michele is way to young to quit working she will only be 48 years old. She isn’t happy about that part! Lol

So apparently in 34 months, 3 days, 4 hours, 49 minutes, and 55 seconds I get to retire at age 55. But hey who is counting?

I have watched so many of you do these dream hunts which often times take what I call big money! Some hunts I have no desire to do because I cannot justify spending 20+ thousand on a hunt. But that is just my view and I don’t blame you guys for doing those hunts. I will have the $ just myself cannot justify those cost to hunt.

I do however plan on traveling a bit. Perhaps driving up to BearTracks lodge in Spring helping him with chores and what not about his camps.

Visiting Serb in Colorado doing an annual otc elk hunt.

3 years ago Metcalf aka BigPizzaMan text me hey brother want to go to Africa my buddy had to cancel great cancellation price! My reply was sorry Bro with Morgan’s arm I am worried sick she will eventually roll on the quad buying her a side by side for her birthday! Tim replied she will enjoy that more than you will enjoy a hunt!

I see all of those types of decisions not having to be made as she will be 20 years old and we will be nest free!

So for all the chatter but as I draw closer to retirement I cannot help but wonder what that chapter in life brings for so many....

I can tell you this.....I retire in 6 months and my hunting WILL increase. Can't wait.

I retired four years ago.. I went from about 20 days of hunting per year to 60 + days per year. Best thing I found is that I can hunt at a much more relaxed pace no need to squeeze every day regardless of conditions. Having a retirement home in the mountains helps Retirement will come soon .. never wish time away.

I cannot wait for my cabin to be built in the spring. Well more like home with 2000 sq. Ft.

On hard rainy days not being cooped in a camper and being able to just enjoy the day like being at home.

Having a place to take a hot shower without having to drive 20 minutes into town.

I look forward to grouse hunting again and definitely rabbit hunting

Retired fourteen months ago and hunt from August to basically March. I’m in no rush due the amount of time on my hands.

I am getting my “big hunts” (sheep, bear, moose,etc.) done while I am still: 1) working with enough income to afford them and 2)young enough to climb the mountains.

The only expensive hunt I plan to do in retirement is an Africa trip - primarily because the physical requirements are minimal.

My actual hunting time will still increase but it will be chasing big whitetails on my farm and DIY elk/mule deer/pronghorn hunts out west with my buddies. Those hunts are just as fun, but much less expensive.

I have less than 300 work days left until I plan on retiring. I hunt/fish a lot already, Im not sure if I will do much more.

Right now Im dwindling down my accrued vacation days and on my way to Neb for WT deer hunting this morning

7 more years and I'll let you know... but my bet is that my hunting will increase! That said, I am of the mindset that I want to do everything that I possibly can while I have the money and health to do them... It stands to reason that we will all fall on bad health, that day may be in our 80s or in our 50's-60's. I don't want to regret passing up on the opportunity to experience today what some wait until later in life to do. You're not guaranteed tomorrow.

For what it's worth, you could do both of your dream hunts for around $5K or less a piece, if you planned/networked properly. I'd dream bigger... but that's not up to me.

My guess (few years from now I'll know) is it will increase locally. Now when it's crap weather on weekends you still go out cause that's all you have. this week is perfect example, rain/wind Sunday, knocked out power, so Sunday hunting was out (literally not safe to be in the woods, never mind a tree). PERFECT days Monday, Tuesday, Wednesday especially for a cold early morning hunt, but nope, up and off to work!

Western, time will tell, we do a hunt every other year (WY in 2018!) and this delays retirement a bit, but we decided we've seen to many people scrape and skimp to get to retirement early, then die or get sick, so we are running a middle of the road, attacking debt, but also having fun along the way.

After you ride your bike out to Sturgis you can stick around afterward, I'll take you antelope hunting. There's all kinds of little things like that you'll be able to do because the time off isn't an issue.

Hunting and fishing increased. The best part is getting to do things midweek when most others are working. I have not built the cabin yet, but it will be tiny off grid crash pad with an outhouse.

That’s the cool part about when I retire Nick about affording those 5k hunts.

The last several years well since Morgan had cancer we have been slammed with medical deductibles. This year the highest at $14,500.00 these medical visits eat up a lot of vacation days as well.

Always family vacations, college, cars, (to many cars boys drive terrrible) side by sides, medical bills, lol Michele new annual purse inventory. Having a 4 bedroom 4 bath house and cost to keep it up.

I always put the wife and kids before me and my hunting. No regrets on that and that is 100% my Call.

I cannot touch my 401k until I retire then it has to be a systematic withdrawal until age 57 do to our plan setup.

I talk to BigPizzaMan a lot and he was shocked at my portfolio and said he is eager to start doing some hunts with me. As I said I do plan on hunting a lot more as I will be able to afford it. Like I said and I told Tim don’t look for me to do any hunts that are over 20k when I retire!

The agree networking is definitely the way to get onto what I call good hunts. I do get invited almost every year here on Bowsite by folks asking if I am up to joining them? The standard response not in the cards this year, money going to other family obligations.

I have 1/2 my family who lives in Courd’Alene or however you spell it? I do plan on those hunts for sure.

What I am really excited about is the roughed grouse and small game hunting just for the mixing of hunts.

So as for the networking? Who is looking to do a big hunt somewhere in 2020????

Brotsky it’s a deal on the lopes!

There is a fella BigPizzaMan and I met in Mexico while vacationing with the wives who lives in North Dakota who loves to pheasant hunt. I plan on doing that as well.

Brotsky it’s a deal on the lopes!

There is a fella BigPizzaMan and I met in Mexico while vacationing with the wives who lives in North Dakota who loves to pheasant hunt. I plan on doing that as well.

Have fun all you retirees. . . . I doubt I'll ever retire fully, but I'd like to at least be able to take off big chunks more often.

In a tree as I read this. "Enjoy yourself, its later than you think"

Kelly, the biggest thing that you're gonna enjoy about retirement is what PECO said, and it might also be the worst thing. You will be able to hunt the best moon, if you believe in that, the best weather, the best wind, and when others aren't in the woods. In fact, my son and I are gonna hunt next Mon, Tues, and Wed. He had to take vacation days to do that. If you're like me, most of my hunting buddies are younger and still working. On top of that, they're not in a monetary position to do $5k hunts.

There's a lot to what Nick said about doing those hunts while you're young and strong. I practically begged my son and his best friend to start elk hunting several years ago while they could. I think the lack of any knowledge about it overwhelmed them. When I was young with a housefull of kids, like you I put them first. Lots of seasons I only hunted on Sundays or didn't get to hunt. The oilfield is good for paychecks, but time off, not so much.

Now that I'm retired, there's no pressure to hunt on days that are less than perfect as far as wind, temps, etc. In fact, I should be in my blind right now !

Here is something to think about-

Eligible for retirement is one thing; ready to retire is another thing.

I would suggest having serious dialogue with your investment planner/advisor before before making any decisions. You and that person knows your income and financial obligations better than anyone on Bowsite.

I was in the personnel arena for 35 years. I saw many people who retired and were miserable. I saw others that were ready and were/are happy as a pig in the sun. I happened to be one of those people.

I'm retired and hunt a lot but life gets in the way. I have a Dr. Apt. Today and a funeral for my Brother in law tomorrow. I used to hunt in all kinds of weather now if it's too cold, too hot, or too wet I just chill out. This year I have three Doe tags and haven't shot a doe. I have two weeks left of Archery, one week of gun season, and second Archery and Flintlock season. You can afford to get real picky. I see some does now and don't even pick up my bow.lol I also hunt with a self bow and a compound, i could of tagged out using my compound but like hunting off the ground with the self bow. I haven't seen a legal Buck all season but would pass on a small one unless I was using my self bow.

I also have a lot of time to fish, I tie my own flies and started using bamboo fly rods. Tying flies gives me something to do in the winter and like to try new paterns I create.

I've been retired for 2 1/2 years... I've never been busier. Ed F

Best thing about being retired is if you never have to count vacation days again !

My hunting and fishing definitely increased, as did my enjoyment. I no longer feel like "I have 10 days, I have 8 days, gotta get it done". Now I have the whole season and if the weather is bad I can take a day or two off. If the animals aren't there I can take a couple days and move. The pace changed. Between Coues, turkeys, deer and elk I may hunt 90 days this year. And I fished a LOT.

My drive for "trophy animals" changed too. I still like to hunt big animals, but now it's become more about enjoying the process of the hunt. I don't do guided hunts - that takes away from the overall process for me. I'd rather try hard and fail on my own than have some guy (like me when I was a guide) lead me to the animals or put me in a stand they figured out.

We live a modest lifestyle, have both houses paid off, and my wife has her own passions to keep her busy when I'm away. She knows how hard I worked all those years in a job I hated to get to this point, and is totally supportive of my hunting-fishing passion. I believe that element (supportive) is the key to enjoying life to the max after retirement. That, and having passions.

A friend told me the other night he is afraid to retire because he has "nothing to do". I highly recommend getting involved with volunteer projects with things you enjoy.

Great points Buffalo and ground hunter!

Last year I paid cash for my used 2012 Harley street glide with 3300 miles on it!

I sold my 2004 truck 2 years ago after owning it for 12 years and bought a 1 owner 1997 Dodge Ram for 1500.00

Buffalo I will make more with my pension and only withdrawing 3.5% from my 401 than I would working straight hours with even some overtime.

Lol it will cost to much to keep working! I would have to live here to surpass my monthly retirement plan.

But that is why I saved so much in my 20’s, 30’s & 40’s in my 401k with many years capping my annual contribution by November.

My grandparents and great uncles and aunts lived into their late 80’s and some into their 90’s with poor diets and almost all smoking tobacco their entire lives.

Guys I really appreciate these comments it is nice to see not one set back from retire from the post so far.

So far my net working within one hour has me on a antelope hunt with Brotsky!!!!

So far Today looks to add a few more cents to the retirement plan!!!

God bless President Trump!!!

Kelly, for me, number of hunting days actually decreased. After doing it more or less for a living for over 20-years, I cut back. I now hunt only when I really feel like it and that amounts to about 30-40 days a year. That is down from close to 100. I think you will find, that with no every day job requirement, you may pass on the bad weather days.

Ed, my hunting partner has been saying the same thing for years. He retired back in 2005 and says he has no idea how he got things done when he worked. Priorities I guess.

Many years ago I went through a divorce which financially cost me dearly. I had to start over. Like Kelly, My new wife of 16 years is young, also named Michele. I wont be able to retire for another 6 years at 62 but I know my hunting will increase dramatically when I do. My wife wont retire for at least 10 years after I do. Nick makes a good point about being young and in good shape enough to do hunts while he can. My goal is to stay in the best shape for my age as possible. paul@thge fort is a huge inspiration in the regard. But for now due to vacation time, or I should say the lack there of I don't have the time to hunt that I will have when Im retired.

Got to retire early(58 due to a plant closing).I was well prepared with a decent 401K and two pension plans+medical(huge).Started full time work at 19 and was planning to retire at 60,so got out a little early.My wife is the same age but still working.House has long be paid for and have two new vehicles in the drive with a small lien on one of them.I had started an uplands preserve five years before I retired;so I keep busy with birds and bird dogs and lots of time to deer hunt .One thing you forget when you are working and busy with life;your health may determine your enjoyment of retirement.

Might want to rethink that ND Pheasant hunt. We lost about 80% of them last winter.

I agree with an above post that time is what opens the door, even on a fixed income you can come up with more activities then you can shake a stick at.

I have been semi retired for a couple years and have been having a blast, for 30 years I had to squeeze in my elk and deer hunts but now I feel like a bird dog being released in a field full of birds.... I now own an english pointer and am getting ready for a long season of bird hunting, the cost is relatively low and there are so many different species to hunt. I also am increasing my fishing trips, the cost is low there as well, just fuel the truck up and go. I also started applying for every species in my home state, it's something that I couldn't do for a long time. The reality is that there still isn't enough time but it's not a problem anymore.

I've retired twice, first in 2009 where I had a chance to retire and start drawing full benefits at age 56. Later that year I had the opportunity to go to work in BC where I double dipped for five years....working and drawing retirement income too. It was a great way to top up the bank accounts......and take advantage of what BC has to offer for hunting. I liked it so well I retired three years ago to gain that extra time off to hunt up to about 100 days annually..........not enough time available to fish but maybe next year.

Retirement has worked out really well with an annual Stone sheep hunt or two and Coues deer excursions to AZ. Mt Caribou, moose, Roosevelt elk, musk ox, brown bear, grizzly bear, Dall sheep, black bear, whitetail and mule deer hunts have been mixed in for variety. A bit of predator calling for coyote, wolf, bobcat and lynx spices up the winter too. Can't beat having time to go!

Good luck in your retirement!

One critical factor for early retirement is health insurance. Unless you have some sort of company benefit that covers you after you retire, be prepared for MAJOR sticker shock on the individual exchange. Nearly $2000 a month for a couple, with a high deductible on top of that, really takes a big bite out of the post-retirement budget.

I have friends who went back to work after retiring just for the health insurance benefits. They wildly underestimated what it would cost.

Congrats to you Kelly on retirement and on your diligent savings. Our country would be in a far better place if more people had your discipline. Don't guess at this. The first few years of retirement are the most important and have the greatest long term impact. Take too much out early on and you lose the earnings power of those assets -- to the detriment of your later retirement years. You need a sound financial plan to follow. Retirement mistakes are too costly. I also agree with having a serious and detailed discussion with a trusted financial planner.

The single greatest thing about retirement is, being able to hunt when you want, not just when you are "off".

I’m planning for retirement, but don’t plan to. My job is such that, unless I end up with major medical issues, I will physically still be able to do it into my 80s, Lord willing. My Dad is 82 and is still working at about 70% of my workload. He sure doesn’t need the money, but he likes what he does and enjoys staying busy. I will definitely slow down some, but don’t plan on stopping working.

Bowriter as I was making this thread I was thinking about you actually and was wondering if your hunting decreased or increased or stayed the same?

Jaquomo I have a really good retirement healthcare plan.

I will second the comment about health insurance. Living debt free, health insurance is our biggest monthly expense now. That is the ONLY reason I have not retired from corporate yet, but have plans to do so soon - I hope...

I retire in about 5 years and will most certainly do more hunting. Will probably change from muzzloading hunting to a bow in Colorado since they have essentially a month you can hunt with a bow. Gonna build my cabin in the mountains in the next 1-2 years.

But I have a ranch that is only a hour away from my home, so in addition to hunting more, I will declare war on "cedar" trees (ash juniper) on the ranch. My retirement gift to myself will be a Bobcat with a cedar cutting attachment on it. Got 1000 acres of it to work on, so that will keep me busy for the forseable future!

I'll be retiring about 2 months after you Kelly and I'm about the same age... I'll be 54 when I retire.... I plan on doing a lot more hunting....... a lot !!!

I'll let you know a year from now. Retiring in March of next year.

Yeah, I'm almost 55 and plan on retiring when I'm 60. Should be financially ready by then. My job is great in that I get a ton of vacation time, but it is pretty physical work during parts of the year. I try to stay in shape for both hunting and my job, but my shoulders are starting to limit me a little. I say to myself that I will hunt and fish more when that time comes. We'll see I guess. It would be nice to have a little piece of land to fart around on and stay busy. I don't really have huge aspirations for bowhunting. Chasing whitetails a lot and an occasional elk hunt. But my bucket list includes a mule deer and pronghorn, maybe a moose hunt. But I just really am fulfilled by chasing midwest whitetails. Good luck when the time comes that everyday is Saturday kellyharris.

Kelly, if I could equal my income the answer would be Hunt more.

I am scared as hell when it comes to retirement. Right now the best I can come up with is right at a $100K a year and is substantially less than my current income. I was poor for the first 18 years of my life and don’t want to be again. My 401K is primarily planned for my wife since her family lives for freaking ever. So so the really expensive hunts will not happen. DIYs and Mike’s Outfitting may get some business though.

Pigsticker you do realize that at 100k per year of working adults in America that puts you in the top 5% income??? Btw I should be very close to equalling my income less current overtime.

I am a blu color beer making 100% DEPLORABLE UAW member!

Yes a rare breed a staunch Republican who is also in a union! ;0)

That being said one of my best investments of my lifetime is my union dues.

So as for retirement healthcare I am pretty set as is Michele.

Morgan actually qualifies for partial permanent disability but we have never went that route?

When I do retire she will be a sophomore in College. If the insurance is to high we will go that route if needed. This is something I need to talk to HR about because I am not sure if she would be under my health plan as a retiree if she is a full time student?

Doodle - Damn Bro you might as well have me buried?

At 55 you have a lot of work years left in you. So if you wanted to do the 20k hunts and such find you a part time hobby/job that you can earmark the income from for that specific reason. A guy can make 20 k a year with little effort and enjoy life a bit more.

Deserthunter it’s not that I would not be able to afford a few of those hunts it’s that I have no desire to spend that kind of money on hunting as there is no guarantee. Hell I go years without killing a whitetail.

If I am spending 20k to get away the destination better have a topless pool and topless beaches with hot women!

I have priorities you know!

Hope to hell its more than now.

Hmmmmm..doofle=buck dufis=troll I suspect.

So far my net working within one hour has me on a antelope hunt with Brotsky!!!!

You will need a long retirement then have you seen his skills as a guide LOL

The only problem with retirement is that you never get a day off.

Doofle's post gets my vote for stupidest post of the year. Good Lord. At 60 I killed my biggest elk and second biggest muley, hunting solo DIY on the ground with a recurve. No butt shots or leg shots involved....

I’m almost retired and hunting right now. I got called in for tomorrow, but thankfully it doesn’t happen often and I can pick the day.

Do I hunt more. Absolutely! But it does seem like I kill less. A bear hunt, an antelope hunt, two caribou hunts and now waiting on a mule deer so far this year.

Doofle

Please go start your own thread and do not hijack this one

Kelly, I retired in my forties. I haven't missed a day of hunting season this year.....and trapping season is right around the corner....not to mention a Kansas whitetail bowhunt with Pat and Mad Trapper starting this weekend. Like you and Michelle, Nancy is 9 years younger than me, and she provides our health Insurance. You will find yourself as busy (or busier ) than ever....the key difference is that once your retire, all of your time and passion can now go towards you, your family, and your hobbies. Instead of balancing between work, family, and personal interests, you will find that the balancing act gets much easier....and more enjoyable, because you get to do things that you want to do, not things that you have to do..... Might I suggest starting a foodplot ot two?....but be warned, they are addictive!!

When I retired from the Marine Corps in 2014 I had four months off before I started working again. It was by far the best four months of my adult life.... LOL

During that time I pretty much did what ever I wanted. I'd sleep in, watch tv all day, do wood working projects, and I hunted more than I ever have. I went to WY and shot a nice antelope with BB, went home to Ohio for a four day trip that turned into three week (my wife was not happy about that LOL), and hunted the heck outta PA.

Now I work for the Navy as a Federal Civilian. I'm only doing 10 years and have seven years left until I retire from this Job too. My plan is to start a bow fishing guide business that operates April through October. In August/September I'll shut it down for few weeks to head west or to AK to hunt. Come late October I'll shut her down and hunt deer, hogs, and/or what ever, where ever I want.

I'm not worried about making a profit on the business. Between my military and federal retirement along with TSP and VA disability we'll have plenty of money to live the dream.

"But a smart man once said "It's time to stop doing what you want to do. And start doing what you were meant to do"..."Doofle out". Thank you for following the advice of that smart man.

Like many, I'm not retired yet, but that will change next summer. I won't hunt longer for elk, since I've been blessed to have all of Sept off for the past several years, so that will remain the same. That said, I gotta admit it will be awesome not having those nasty thoughts of having to go back to work creep in the last few days!

I'll spend more time pheasant hunting. Turkey will remain about the same. From May-middle Aug, I'll be at the lake chasin' walleye, or in the mountains, from Monday afternoon through Friday morning. I'll spend the weekend at home doing chores. Either way, I'll be watching the masses going the other direction whether I'm coming or going !

Getting older sucks in many ways, but there's also some darn nice perks that go with it! ;-)

Trying to figure out if doofle is trying to be funny (if he is I can laugh at that kind of humor) or if he recently picked up traditional archery. It's hard to tell.

Doofle,

Your dr. called and left you a message. Thinks you got the wrong Rx. He meant to double your medication and add a laxitive. You are full of it son !!!

Only you can decide how much hunting you want to do. You do not have the constraints that a work-a-day life involves, but then many times your priorities change too. I can hunt anytime I feel like it....since 2010....but I'm not running in the woods everyday during season. Personal choice, that's all. I guess if I could have retired at 30 it would be different. As for expensive hunts all over the place, it's not an option since I'm not blessed with a golden parachute....big pension. S.S. and what I could squirrel away over the years allows us some considerations, but I never was one for going on faraway hunts. For those that like that, and have the wherewithal, there likely is no good reason not to when you retire. I kinda like where I live and our vacations are generally as a family and to places we all want to see. At 72 (in January) I find I'm very comfortable hanging out with buddies during season, spinning yarns....doing a little hunting, and using the woods when I feel like it. Just stay healthy and you will have more choices than those that don't.

I don't understand how you wouldn't have more time to hunt? Assuming you make it a priority to do with the time that you would have spent working?

Kelly, My wife is 3yrs younger than me and I will be 60 in 19mo. I plan on working another 4mo so I get 25yrs here at work.

Like you we have saved for this. I have a good financial planner and we have done multiple budgets to make sure we can do this. Like you we already have land to build our retirement home. We've had it for about 17yrs.

I have a good paying job that is secure as jobs go. Work does not know my plans because as much as I want this and look to be able to afford it. I am honestly a bit scared. In my line of work it might not be so easy to go back and certainly not at my pay rate. So, I keep telling my wife, if we do this, if we choose this we need to be right. Everything tells me we can do it. My financial guy says no problem. I guess it is just some kind of middle class guilt or 1950/60's upbringing. Ha

We have really had bad weather so far during my deer season. I was just telling my wife if I was retired I could hunt more, hunt when weather was better and surely be more successful. Our retirement land is pretty good deer hunting. I love making food plots and just general working the place. I also want to do a Mule deer hunt but that is about the extent of my out of state bucket list. I have been able to get a lot of other critters over the years so they are not an issue.

Bottom line, yes, I am planning on hunting more! Oh, fishing as well.

Bill

I'm glad to read about the guys retiring and still hitting the woods. All the guys I know have pretty much hung things up by 65. They might gun hunt a few days but their friends don't hunt much anymore or have died. Most like seeing game but not much into the killing. At 52 and looking at retirement in 8 years, I see myself traveling a lot. Hog hunting in GA during the winter, sneaking up on bears in western Canada in the spring, Musky all summer in the U.P and WI, birds out west in the fall with a few weeks back in Canada for moose/bear, than back to GA for hogs in the winter. That's the plan anyway. I might even have a beer at 8am!

I do know I'm not going to be watering my lawn 7 days a week so I can mow it 4 days a week. The junk mail from AARP will still not get read. Cracker Barrel won't be seeing me a 4 pm. A young gal with a nice rack with still turn my head (and I'll still think I can have her lol). Kids can be on my grass if they want to. Won't tuck my undershirt into my under wear (if I even wear underwear). I other words, I ain't getting old.

killinstuff, I’ll be 64 in Jan. I guess the difference is those that hang it up by 65 hunt because it’s something to do. Those that have no thoughts of hanging it up hunt because it’s who they are.

I will admit, my priorities have changed. Used to be, I wanted the biggest in the woods. I’d worry about getting him out of the woods once he hit the ground. Now, if he has branched antlers and is reasonably easy to get out....he’s in trouble! lol!

You know, it seems to me, a lot of the not yet retired guys, must not be married. Do y'all have any idea how much work your wife is going to dream up? Friend of mine, said he was going to have to go back to work to get some rest. Here is the thing. Lot of talk about finances and insurance. Yes, Insurance is huge. But remember, you have not signed a contract that says you have to hunt six days a week. You go when and where you can afford to go. It is critical you live within your means and hunt within your budget. If you don't, you are going back to work. I cannot fathom, anyone retiring unless their house is free and clear and they have a good retirement income, just so they can hunt more. First you take care of old age. Then you take care of hunting. That is why, I have always advised young hunters to go to the bank, borrow money and take the hunt of a lifetime while they are still able. If you have nothing, the bank can have it. Or something like that.

The real question to retire-ready is: are you wanting to maintain life or a lifestyle?

If I were just interested in maintaining life, I can retire today...

Kelly, not to offend but I see you as somewhat of a socialite. With this said, I think you will hunt more, with more people, and overall more of a quality experience. I do not see you road dogging as as Charlie does every fall but I could 3 weeks at your cabin multiple people every year and maybe a run out West. Me on the other hand is more antisocial and probably will never get the number of invites that you received on this three alone. I could me doing September elk, mule deer, and hitting two or three Midwest states for whitetails and be back in Georgia mid November. Anything more than one person for me is typically to many so these will not be campfire extravaganzas. I can retire in 18 months and may but if I choose not to I wil make myself quit at 64 because I know that Father Time will eventually take its toll.

Also, I can see you grandpawing it getting grandkids involved in the outdoors.

I got about 7 years let will i hunt more, probably not, like others have said i will pick and choose, i will fish more though

My finances are in order the house is paid off in 2 years. It’s a 4 bed 4 bath way to big but Michele says she doesn’t want to move! Lol

My health care is in order as well.

My roofing company has been in Michele name solely as per my tax gal for minority bidding purposes. Our oldest son manages the roof jobs for us and is a limited partner. Other than that no employees all subcontracted! :0)

My dad is at our lease at age 74 hunting his butt off all by himself. Hopefully he is still able to hunt which I am sure he will Be and I plan on taking him on some of the easier hunts and spending some of this retirement money on hunts for both of us.

Hell if the Market keeps going the way it has since election night he’ll i may even have strippers flown in for him! Lol just kidding.

Medicineman- you’ve been to my lease not much ground for food plots!!!

Loving this thread guys thanks for sharing.

Yes the cabin will be great and yes I plan on swapping a lot of hunts and I definitely plan on doing a lot of Salmon fishing with my buddy JayG.

One cool part of the cabin will be for disabled kids to bring them to hunt for the youth hunt! I have had kids with cancer out who wanted to hunt for Make a wish but they do not offer hunting anymore (I understand they don’t want to hurt donor base)

With the

I hope I never fully retire, love to work and enjoy the income. Hunting is my third priority to family and work.

I retired a year ago this past September. I definitely hunt, fish and golf more. Nice think is I do it during the week and leave the weekends to the workers.

I've retired once from the military and now work as a federal civilian. I should be retiring in 3yrs. I'll most likely be hunting more. I can't wait.

The nice thing about my job as a veterinarian, is that I can work as much or as little as I want in retirement. Plenty of work for relief vets. Should have a good retirement income plus can work a little here and there to get some "play money" (hunt money!)

I retired at 51 with no bills, good retirement check, great medical and dental. The wife kept her big city job and works from home in our small town and does great. We got married when we were 21 and 20 and broke. Had two kids who are on their own now. We worked our way up to were we are now by smart investing and living a very modest and thrifty life......I guess we did it the old school way....a penny saved is a penny earned. We now snowbird every year for 3-4 months as the wife can take her job with her. That is a great thing if your wife has a job that allows that!!!! I got real sick (cancer) about a year after I retired and that set me back a couple of years. It is a lucky thing we have great med insurance with low deductibles. Getting sick wasn't in our retirement planning but stuff like that can happen to anyone reading this....ya just deal with it and keep moving forward with life.

Guess I have a different take on retirement life these days. I used to hunt ALOT during my last few years of work and into my early retirement. I can honestly say I got burned out on hunting...at least deer hunting. Most of my life during that period seemed like it revolved around deer hunting 365/24/7. The burnout kinda sneaks up on ya. I remember getting off work and heading out hunting to get away from things. I thought it was a great way to recharge the batteries. I just had to be out in the woods deer hunting...or so I thought. One day while out in the stand the thought hit me that it's no longer fun, I'm just going thru the motions of hunting. I no longer enjoyed it. Work, hunt, eat, sleep a little, work, hunt, eat, sleep a little, etc. Ya, I killed alot of animals in that time period...however some are just a blur now. I thought it would be different upon retirement but not really. The teachable moment here....pace your deer hunting very wisely. It might be a shocker to some, but life does not revolve around deer hunting. I seem to enjoy deer hunting more these days now that I deer hunt a little less.

Dad killed a buck this morning at 81. I hope I get to hunt that long. I do miss being able to get up early and hunt, them work an eve watch, and still have plenty of energy. Retirement will be nice so I don’t have to worry about the work part!

My last day on the job is December 31, 2017.

35 years all said and done.

Right @ $5k a month after taxes and High Option medical/dental deductions.

I hunt quite a bit already so I might just be a Camp Jack and help others out with the tag they have.

I am thinking about selling my Utah home and buying in Belize for the winter months and staying in Wyoming the spring/summer/fall months.

Good luck, Robb

One thing no one mentioned, maybe because I am the only one. At 73, I have unfortunately, outlived all my hunting partners. Some years ago, I realized, I actually wanted to hunt alone, enjoyed the freedom and the...well, can't explain it. I have been a solo hunter for well over 10-years. I could tolerate some campfire time with others but as time goes on, I enjoy being alone in the woods even more. Here is where I am going with this. That means taking special care, being extra cautious. Even a simple fall on hard ground could be bad and if you are like me, you will begin to hate long distance travel. There are a lot of changes that slowly creep up on you. I strongly suggest, if, when you retire, you are still healthy and full of P&V and can afford it-take those "wish-book" hunts now. The second thing, I suggest, is choose your hunting partners with care. As you age, your tolerance goes down. Thirty-years ago, there were five of us, all about the same age, all somewhat upward bound financially, all with the same interests. By 10-years ago, I was the only one still living. Go while the people you really enjoy being around are still around. (Today is the 11th anniversary of the death of the last of my partners. At age 66, with no warning, he fell face down in a huge bowl of pasta-he was a master chef-and was dead before he hit the floor.) We were to leave on Nov. 4 for a ten-day hunt in IA-MO-NE. Now, as an addendum and sorry for the length of this. My wife, a doctor, is almost 10-years younger than me. She loves her job, works 3-4 days a week, makes good money. Obviously, my insurance is Medicare and supplements. Now a warning. To some degree, if you haven't, start a separate bank account to which you contribute from your income just for your use. This will head off a future "debate" about spending her hard earned money etc. That is not the case at our house because we have had separate accounts for many years that each of use, as we see fit, for our own enjoyment. We have been married up for almost 42-years, survived some rough times, have our own interests. Retirement brings a whole new set of considerations and takes an adjustment period. Yes, I fully realize, I retired from a job, many would love to retire, to. Hunting and fishing close to 250 days a year, does become work.

I don’t consider walking out to a deer stand a couple hundred yard away, for an evening hunt, a day of hunting.

If that’s what some are counting toward their 100-200 days of hunting, sorry but that’s not a day of hunting.

Traveling, camping/staying away from home to hunt takes more time/days and that’s what will wear on you.

I have come close to being burned out on hunting a few times. But that’s after preparing and hunting elk for 3 + weeks, then hunting deer, either in state or out of state

Knowing this, When I retire I will prob hunt pretty much the same as I do now.

Are we really going to split hairs on what a day of hunting is or is not? Melvin Johnson killed the world record whitetail with a bow on an evening hunt if I am not mistaken. I am sure he considered that a great day of hunting.

I'll make sure my wife understands that if I come back at night then technically I didn't hunt that day....I like it

2 hrs at work ain’t a work day. :)

If walking out to your stand ain’t hunting, WTH am I doing right now ?

I need help to plan ahead and act, so to speak, in order to ensure the possibility of retirement. How much of a nest egg are you guys talking about needing to retire with a said dollar amount per month. I believe a 5k a month fiqure was stated earlier so can we use that as a marker??

Loess, I figure 75% of your current income to maintain your current level of living. A dollar amount for me is not necessarily the same for every one. For some $5K may be a pay raise for some it is $5K short. You can do this a variety of ways by reducing cost like house payment, downsizing, investments, empty nest or whatever. I personally feel that I need a minimum of $115K a year to live the way that I want to once retired.

Cnelk, my evening hunts are demanding in some ways than the three week hunt that I am currently doing.

I would like to know what others think who make in excess of $150K a year.

I plan to spend more days hunting and fishing but not going on expensive hunts, just cashing in preference points and enjoying what I can. I think doing high dollar hunts would be too nerve racking for me as I dont have a pension, just 401k and savings.

I agree with Pigsticker that $5000/mo isn’t the same for everyone. I’ll bring in $5000 net in retirement. My wife wants to continue working for a few more years on top of that. However, without the mortgage being paid off, retirement would have been nothing more than a pipe dream.

Ned, all depends on the lifestyle. I know some who are more homebodies who get by on way less. I know others who need $5K a week. Most people I know who successfully retired early (who didn't have a big windfall or sale of business for $$$) worked on their budget for at least a year, tracking every single expense. Then adding in extra for variables like additional insurance costs, more vacation/hunting spending, etc..

Then try to estimate "big things" like a new furnace, replacement vehicle, new roof, etc.. That can come from a slush fund that's set aside. Cost of living varies widely in different parts of the country.

I read a report last week that the average couple that retired at age 65 will need $235,000 for out-of-pocket medical expenses and prescriptions during their remaining lifespan.

In our case I have no pension, no company insurance plan, basically only what I saved and invested. I was broke, divorced and $30K in debt at 40. I set a goal to get out at 55 but the 2008 crash knocked me back five years. Our monthly spend when I retired at 60 was $5K. (That's not flat because some months we have property tax, insurance, LTC policy payment, etc..) So it's more of an annual spend number. Both houses are paid off. That $5K only works because I figured out how to work the Obamacare scheme to our advantage. Otherwise we would need more than $6K to cover the $1800/month premium.

By age 69 our "income" will have gradually increased to over $9K a month, and I'll be on Medicare.

We have a slush fund for big unexpected stuff. We also did a reverse mortgage line of credit on our primary home, which is an awesome deal if you do it right and don't plan to sell your primary home for awhile. The money is there if we need it for something catastrophic, and it earns interest every month while just sitting there.

There are some good retirement calculators online. Run numbers on several. Then work with a fee-only professional who specializes in retirement planning.

Retired March 09 & this year is the first year I missed 3 to 4 weeks CO. elk hunt & that was because of a couple accidents that my hunting partners had. Yes I do hunt WT more now than I did when working but at 72 I am cutting back some & only going when I want to not have to, better weather has got to be important, clod wet morning used to suck but I was out there. When it got to be Nov. was out there every morning & evening & many days all day long but if the weather man says possible rain in AM I no longer bother. Have never been on a guided hunt always DIY & have been successful as taken Elk, Caribou, Antelope, Bear, Mule Deer, & lots of White Tail. The only thing I still have on the bucket list is Moose & looking like I won't be adding that as not willing to pay the high cost that the moose has gone to, as have hunted them 2 time in AK & got close but not close enough. Like some other running short on hunting partners & the ones left won't do the moose as to physical. My 2 main hunting partners are 52 & 42 & time & work is there hold back. When not hunting mt 2 Granddaughters keeps me plenty busy & love it.

I'm 52 and own my own business. I'm thinking more in line with Pigsticker in that I'd like 10k a month in retirement. I'm getting close, but not quite ready to give up the high dollar hunts. When I retire, the high dollar stuff will end. I planned financially to be able to retire at 50. I hit that goal, but now thinking I'll go to at least 55 maybe 60. I too have preference points all over the West that I will be able to "cash in on" when I retire. That will keep me busy for a few years. The killer for me will be health insurance. I don't have a mortgage, I don't owe a nickel to anyone, but can't stand the thought of dishing out in excess of 2k a month for Health insurance. Honestly, that is about the only thing keeping me from retiring. (well, that and sheep hunting:)

Pigsticker, I don't think percentage of income is a good number to use. It's really about how much you plan to spend. We spent way less than 50% of my income when I was working, which still let us pay off both houses and invest enough to retire early. Having an awesome second house in the mountains with trout fishing, etc.. all around is our "vacation resort" whenever we want, for weeks at a time, so vacation costs are minimized.

One other BIG consideration many miss: long term care. Nursing home costs today are around $9000 a MONTH. Medicare pays zero. It's all on you. If one spouse needs skilled nursing or nursing home care, it can bankrupt a family pretty quickly.

My mom is in a nursing home, has been for a few years and looks like she'll live a lot longer. She has spent hundreds of thousands of dollars and when it's all gone luckily she is in a facility that accepts Medicaid. But most dont take Medicaid and there's a shortage of Medicaid beds. They wheel them out to the curb in that case, and some family member is on the hook.

$3000 a year for a LTC policy may seem like a lot, but not so much when you figure how fast a nest egg goes away at $9K a month.

Jaquomo, my mom is in a nursing home too. The smart thing we did was hire an elder care lawyer to guide us thru the many laws to keep her/us out of trouble. The big thing to remember is don't get funny with the money just before she/he enters the nursing home because the Feds will find out. There is something like a 5 year window that gets looked at. Any money/estate transfers need to happen before that...at least the time we went thru this. Things may have changed since. My brother had to follow the lawyer's advice and spend down her savings on certain upgrades to her house to get to a certain level by a certain time. Her medicaid (or medicare??) pays for the nursing home. I recommend to anyone to hire a lawyer that specializes in elder care to protect everyone and the estate.

IMO the money spent on the lawyer is well worth the saved stress worrying about your elder parent's well-being....especially if you are close to retirement yourself.

Congrats Kelly...as well as all of the other near and current retirees out there. I've got plenty of years left to work but certainly look forward to the days when work is an option instead of a requirement. Hearing how you guys went about getting there is encouraging.

Her Medicaid pays for it, and that only kicks in when her total assets get down to $5K. She's lucky to be in a facility that accepts it. My next door neighbor's aunt is in one that doesn't accept it and there's a waiting list for Medicaid beds in our area.

You're right about the 5 year "look back" on asset transfers. We sold mom's house to pay for care vs. turning it over to to the government when her other assets get to $5K. That kept is in control since she was never going back home. And +1 on hiring an eldercare lawyer. Worth every penny.

Some states have "filial responsibility" laws. That means the next of kin basically has to also go bankrupt before state Medicaid funds kick in. Our state doesn't have that law, thankfully, but after I did some research there are a bunch of horror stories of retirees basically going broke paying for their mom's nursing home care.

"Then work with a fee-only professional who specializes in retirement planning." This!

Jaquomo is a wise man. And he also brings up a good point about LTC insurance. 60%+ of the population over age 65 will require some sort of Long Term Care at some point in their lives. That means odds are, either you or your spouse will need it. Nothing will derail a well laid out retirement plan like an expensive stint in a convalescent facility. Fortunately, if you have some cash set aside, there are other more flexible options (with premium refunds if insurance is not used) for LTC insurance now than just the traditional $2-4K per year outlay. And BTW, LTC insurance gets WAY more expensive after age 60, if you can even get it. Plan early! And you CANNOT rely on Medicaid LTC. It's incredibly hard to qualify for and most facilities that accept it are not the type of places you'd want to spend your last days in!

The people quoting a certain amount or percentage needed to retire are kinda funny. There is no standard. There is no rule of thumb. There is only right or wrong for your family alone, period. Anyone planning for, entering into, or currently in retirement better know what that right number is! There's no room for guess work.

I feel for those that are waiting for retirement to start doing the things they want more. I have worked a shift schedule that has let me have half of the year off since I was 18 years old working 7 days on 7 days off. Have fished and hunted as much as I wanted pretty much all my life, you never know if today will be your last day. But enjoy your retirement when you get it, I feel like I have been retired the past 30 years I guess. :)

Doofle....your post cannot be even a serious joke. Just returned w/two of my hunting buddies from a very successful trip to NL for moose. All three of us are over 70! All three took bull moose and we helped our guides process the animals on the bogs and in the meat house. Just thinking you may need to stay in bed until your head clears. We who are over '50' have done far more to preserve and defend hunting and fishing than those who might slam the 'over 50' folks!

Nursing home??? I'd rather get taken to the farm, get popped in the back of the head with a 22 when I'm not looking and rolled into a deep enough hole.

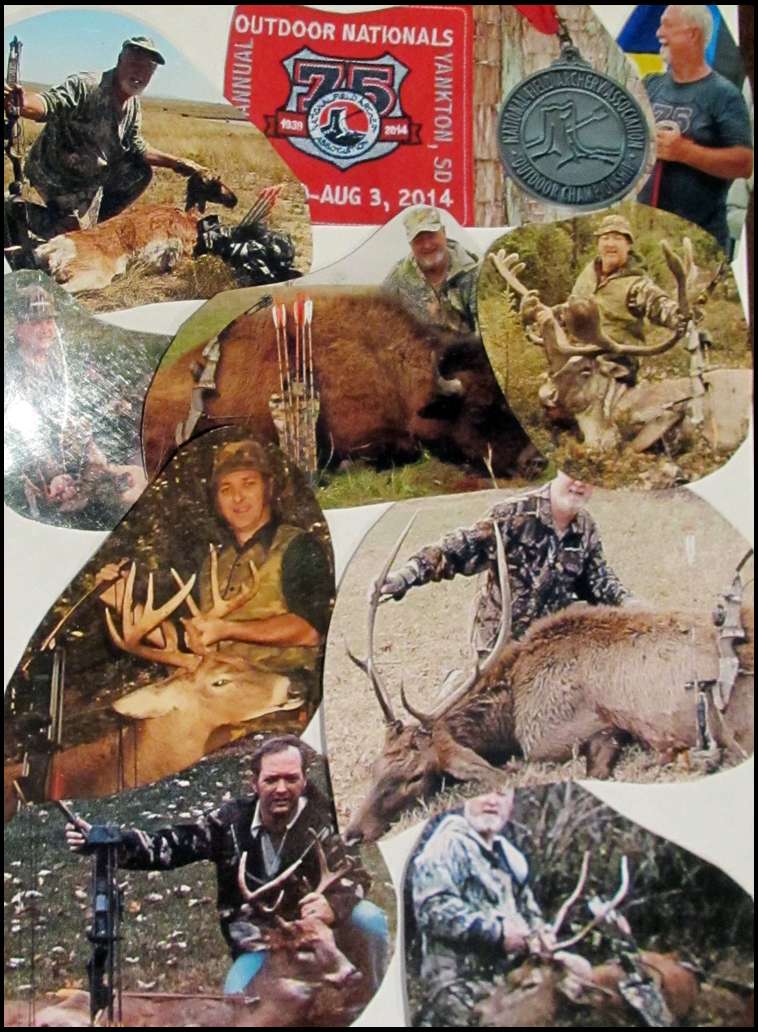

I retired 16 years ago. I have been out ONCE this year at home BUT I normally don't start until last week of Oct.. Why? I no longer shoot Does & set a personal goal on my next Whitetail Buck (only animal I have put restrictions on myself). Why? I have well over 100 archery Whitetails & plenty of both & I'm well off enough not to have to hunt for food & I leave them for my younger kids/g-kids (8 family members that bowhunt). I have FIFTEEN G-kids & family is always 1st. Even though family events kept me from starting my usual last week of Oct. I still will have 3 weeks of early season & best time to be in the woods.. I will pretty much hunt the rest of early season. I also manage a couple out of state off season bowhunts in Feb or March & go south for pigs with my adult son. We also try at least one other Biggame bowhunt depending on his work schedule.. In spring, I get ready for NFAA Field (State, Sectionals & Nationals) & Target (state & Nationals) competitions that I enjoy for myself & several fun 3-Ds with the kids & G-kids. Indoor winter is taken up with 300 rounds & state/sectional competitions & one or two big indoor shoots if possible. I don't normally hunt weekends & leave the woods for those who still work & have limited time (I did 40 years of that). So, I pretty much do what I love year round & do my yard work in the "middle" of the week. I tell my wife, WE choose when it's our weekend. Oh, her & I manage going out at least once a week & yes, WE baby sit our younger G-kids often (that's what I have done all this week & not hunting as Daughter & her hubby are on a badly needed vacation). They all know that "I" am unavailable after Sun.. till Dec1st. I LOVE being retired & tell my family, If my health stays good, I want to live forever. Bowhunting is even better as I share many of these trips (local & out of state) with kids & G-kids + several great bowhunting friends I have made over 60 years of bowhunting.

You will never be in better health than today, the cost of tags and gear will never be less and your number of friends will never be more. I lost very few friends from youth until we were all nearing 50. Mostly from accidents up until 50. Now I lose a classmate or friend about every three months. Mostly due to age-induced causes. Am now seeing a lot of empty chairs around the class reunion table and at the pub where my career buddies gather a few times a year. Some have mobility issues now or financial challenges. I like what I do and never plan to quit working but I do plan to change jobs in a few years. I have doubts big game hunting adventures will be frequent or shared with friends very often as I pass through my 60s. The herd is thinning.

Killinstuff, that's exactly what my father in law did. But you have to do it yourself. Otherwise whoever does it is up on murder charges.

About 3/4 of the people in my mom's home are drooling husks who are barely conscious. Very depressing..

Fact = Father Time is undefeated

hunt as much as you can prior to retirement

Exactly! Nobody beats it:)

While I admire those of you who are retiring a such young ages in some ways, I also question it.

"They say the number one killer of old people is retirement. People got'em a job to do, they tend to live a little longer so they can do it." Words of wisdom from Budd... Kill Bill

I'm 54 and haven't set a time frame for retirement. I have a daughter getting married in Dec, and a son still a junior in HS. With her wedding and 4 years of college for him, lots of bills still on the horizon.

Good luck to those who are making it happen...

Ahunter55.....just read your post and it mirrors mine...except i have never been able to use a bow because of an early should injury. 16 years i got out and never looked back. Have to cut this short as my deer and turkey down behind the house are calling. Have 3 nice ones coming in but no room in the two freezers as they are full of moose...have room on cabin wall and can easily donate the meat!!!

I did, and it's in 28 days! Walking around about a foot off the ground just thinking about it. Nov 30 I pull the ripcord!

BigRed, I know people who shouldn't retire because they have no life outside their jobs. Had this discussion with a lifelong friend just last week. He will probably work until he dies. I'm busy all the time, except when I feel like taking a nap. The volunteer stuff and writing articles gives me sort of a "job" to have purpose in life. I work with kids fishing programs, wounded vets, manage two big fisheries, and also on the board of a big archery association. The difference between then and now is that I love everything I do and have a lot more freedom to do what I want.

I have no doubt I'll live longer. My corporate job was killing me with a death by a thousand cuts.

I retired over 11 years ago at age 53. Did a lot of out of state and Canada hunts while I was working and a number after I first retired. Could still afford to go on some big hunts but my priorities have changed and I have no real desire. Have grandchildren and a cabin with property now and I'm content to go there, work on the cabin and land so that my grandchildren will have a place to go when they are old enough to hunt. I'm glad I did the majority of my traveling and hunting when I was younger and didn't wait until I retired to go.

44 months for me and the wife retires the end of this year. Everything in order and debt free!

My plan, God willing, is to go on a few big hunts with my daughter. We are going to Newfoundland next Sept for moose. I would also like to hunt my way across the country one year as well.

The year I retire I want to hit AK for Sitka Blacktails, Newfoundland for moose, CO for elk/mulies, and throw in a Midwest rut hunt. Goals!

Best of luck Kelly, I’m sure you will figure it all out.

I will be debt free as well which makes this a no brainer for us!

Like I said Michele will continue to work she makes 40a year working 3-4 days per week.

On average the roofing company makes the same.

My pension without touching my 401k is enough for us to live on. I give Michele 1600.00 every 2 weeks and the rest goes to 401k and credit union.

So with the house being paid off in 2 years thats an added net increase of 1120.00 month.

We don’t have a huge spending habit because I give michele a set amount of money ha ha.

I think I spend about 9500.00 a year in fuel and that Nasty cafeteria at work. So it should be financially much easier.

I have come to truly hate my job! For almost 27 years I have had to rotate shifts every 5 weeks. Even though we are UAW and I have the 5th highest seniority in the entire department I have to rotate from 3rd, 2nd, and 1st.

I am ready to say screw making beer and making time for Kelly.

Goals caribou, mountain lion, elk with serb, visiting bear track, hunts with big pizza man, small game, fishing and riding my Harley taking US 50 west from Cincinnati all the way to Santa Barbara. Then PC1 down to Route 66, then Route 66 to Chicago, then art 74 back to Cincinnati

For you married guys looking at retiring soon, I might humbly suggest making sure you and mama are on the same sheet of music with respect to retirement plans and especially expectations. Perspectives and views change once you both cross the fence and get a taste of the retired life.

A lot more. But the best part of it is, as mentioned above, you can relax and enjoy it, and if something messes up your hunt no need to worry, you can hunt again tomorrow or the next day, or whenever you want to.

+1 JL. It works for us but I know a guy who thought retirement would be a full time vacation filled with fun and adventures. Wife thought it would mean having him home all the time to do whatever SHE wanted him to do. He had made all the money while she raised the kids.

It didn't work. They ended up miserable and eventually divorced.

Been retired for 9 years now and I'm 64 now. Hunting this morning in Illinois then afternoon in Iowa! If you fail to plan you plan to fail.

Nobody luckier than me:)

JL...you are so right about mama. Just returned from NL for moose and Mom strongly suggested that she would like to see whales/tides/fishing and the moose camp I was in. Passed the thought of touring eastern Canada past her in the near future and noted we could spend much of Sept. in NL which would include her being able to go w/the old man out onto the bogs during the rut. A mandatory grandchildren stop in NNY will be great also. Am re-booking with the outfitter we were with for last of Sept., 2019 this morning!

I'm luckier Charlie. I'm currently in a stand in Kansas, starting my sixth week of hunting since the end of August. I'm very fortunate to have the retirement I do.. I just turned 53. I'm dabbling in Taxidermy to pay for my higher end hunts and my wife took up real estate to stay busy and she's kicking ass. Life is real good right now. Ed F

Not sure how many days I've hunted this year but I've killed 8 p&y critters so far. Semi retired. Have to pay for the princess to go to hawaii.

Wow Bob 8 P&Y so far this year!

I had heard you were #2 on all time list behind Chuck Adams.

Are you guys close in animals entered? Or have you passed him?

I don't really keep track of it. However, my buddy "lol Frank Noska" tells me he has passed me now. Frank is much younger and his gal Millie says he's pert as a rutt'n buck so I'm sure he's the man.

Wow Bob, heck of a year that discredits some earlier troll about retired guys and can’t/shouldn’t hunt! Congratulations, has to be one of your best years yet! Kurt

I think i've seen about 5 P&Y animals this year. Does that count? Wow congrats Bob!

Thanks. I can't believe I messed up and killed a Sitka that is two to three inches under. Supposed to know those better than anything else.

If I can manage a buck here in Iowa and then one in Kansas, i'd certainly be my best year ever.

Awesome, Bob! Good luck in IA and KS, then on to Coues?

That's next year. Course was the first thing I shot in 2017.

Just had this buck under my stand. Don't think he's much more than 100 inches.

That is impressive! Good luck.

Lots for me! I pretty much retired 10 years after college. I saved and bought rentals. My goal was to have time to travel and hunt.

I hunt out west about 3 times a year. DIY cheap air and usually camp. Reasonable prices. LOVE IT

7 years ago I was on course to retire by 50. I had made sacrifices in lifestyle, home, living in a neighborhood versus on a bigger piece of ground I could call my own, vehicles, etc... My wife was on board. We really watched what we did and, we made sure the kids got to live a good childhood. I drove nails on the side and worked procurement for sawmills. I made really good money for that time and we were very conservative in how and what we spent. Then I got cancer in 2010. It was a long hard ride that was rough financially. The co-pays related to the treatments were astronomical. I lost my income for almost a year. I then lost my job due to being unable to work. So, what was gained was lost due to refinancing and, the costs associated with that sickness.

I was blessed with my health being given back to me by the Lord. Everything is not perfect but when you take almost 90 treatments of chemo in 3 months, nothing is going to work as well after ward as it did before. I am now self employed and if things go well, I may still meet that age 50 retirement. I'm sure I'll still work a bit but, I do intend to do 90-100 days a year in the woods, in many different states. So, I'm sure my hunting time will dramatically increase. Lord willing of course.

If I have learned anything it is to enjoy today as well as plan for the future. Had I known of what my future held, back at the start of the 21st century, I would have done more of my preferred western hunts. But, I know God is good all the time. And, I pray daily he intends to see my wishes on this be granted. God Bless

Bulelk1

Brother I am completely lost by your post????

WVmountain-I can relate. I had a ball busting job in a steel mill & decent wages but nothing to brag about. My wife a RN & decent job/pay too. We did lots for our kids (5 total). We did lots together, took G-kids lots of places in summer (we have 15 now) & I did plenty of bowhunting for various biggame in several states + we both had 401s even though I would have a retirement pension from my company. AT age 60 my company "closed it's doors, bankrupt". All the "benefits" we had planned on were GONE. I had 32 years with the Co & after 6 months did start receiving my pension less a discount. Mind you, no SS yet as I was only 60. THEN wife becomes Ill from an spinal operation infection. 38 days in hospital & nearly dies. The next TWO years she is nearly bed ridden (my living room looks like a hospital) & of course looses her job. ZERO income for her. Her meds alone "after" ins. was $1000 a month. We went to Health Dept to see if we could get help with JUST the med cost & they said we had "saved" & had to much money. They actually said, go buy a burial plot. Yes, it was a struggle, juggling & over $50,000 from my 401 used. I am just thankful we had it. Many would have ended up far worse. We have always lived within out means & "planned" for those fun things. We "just" started to get back to normal a couple years ago. It was tough for sure but I feel the man upstairs always came through when it became the worst for us. So to everyone out there, enjoy what you have as unforeseen medical or other financial disaster can happen at any time & to anyone. Now if your an Illigal or never worked it's all covered.

WV and ahunter.....sounds like things are working out for you guys? After I retired and the Doc gave me the long face talk that I had cancer, one of my thoughts was, "who...me?...no way!" 100% correct on unforeseen life events happening. Ya just have to keep moving forward one day at a time. Stuff happens when you least expect it.

WV and ahunter: man those are heart wrenching stories. I wish you the best in your recoveries. I admire your strength and perspective.

Sad is we have health insurance, car insurance, death insurance, long term care insurance, a million dollar rider for the perps that want what you have worked your whole life for insurance, and did I say anything about flood insurance.

Between taxes and insurance then we have life to deal with. It amazes me that we do as well as we do at this gig!

Stocks crash, housing bubble eats away your equity, and banks fees, college tuition and more fees. I am still in the scared to death mode as far as retirement is concerned!!!

Pigsticker, there are two things that scare me in retirement - a disease bomb, and people texting and driving. The way I look at it, we must live life to the fullest and deal with whatever happens the best we can, as ahunter and WV have. One only need look at Roy Roth, Paul Schafer, Jeff Lampe and other great bowhunters taken in their prime. No matter how much they planned, saved, insured, it didn't matter.

Yep. We all are going to be dealt cards that make life hard. We were never promised any different. So, we must learn to enjoy what we do have because those cards are coming for us all. I'll guarantee that. Its just a matter of when. It's all a balance we must learn to manage in our life.

SDHNTR, I'm a blessed man. We are all. While my health suffered, I can still do whatever I want. I'm doing very well aside from a shot every two weeks and occasional IV supplements. I take not one medication. Life is grand once you humble yourself and learn to make the best of it. Its going to be off the charts when I get more hunting time. :^) God Bless men

First is to use your retirement for what you think is important, not some knucklehead who espouses what hunting really is and everyone else is wrong. Your priorities will change over time and what is precious to you in reality will become evident at some point. I can't abide big talking people and I would just as soon not be around them. They will likely fall the hardest in hard times. Keep your faith and love your family, and do what you feel is best for you, and what your idea of hunting entails. My wife and I just had our 52 anniversary and hope to have many more. My family is number one not hunting.

Congrats George. That is impressive!

George, nice to see you post here.

Awesome George. Yes, my family has always come 1st b/4 my Archery. Never pushed my kids into it either & of 5 adult kids now, 2 enjoy my passion. I also have 15 G-kids with 5 I share 3-Ds & bowhunting with. My son is an accomplished bowhunter now. Each year I take the memories of my bowhunting close friends that passed b/4 their time. Jack A., Ed R., Gene R., Arza S., Charlie S., Larry M., Dale M., Chad L., Charlie G., Joey M. (5 of the 10 under 40). I actually reflect on many of our times while on stand. Life IS a series of bumps, curves & a few damn big Mountains at times but they say the man upstairs never gives us more than we can handle (I wonder about this at times). I do keep the faith in those difficult times though. I wish you all an awesome life with all your loved ones & hopefully your season goals will be accomplished.

16 months, zero days but who is counting.....

Bob, great buck! Looks like he is pushing around 145" to 150" and is an 8 pointer! Good job!

Please don't hold the hat against me. I think he's more like 130, but thanks.

I don't know if I am cut out for retirement. I may invert my priorities (drastically, lol ) at a certain age but I think working to the grave is a good plan for healthier aging.

Doofle again, please quit hijacking my thread!

Start your own combative stuff on your own thread!

It’s still just a one acre field!

My excavator was out this past weekend looked at the lot and gave me some good ideas as far as septic system and such.

Doofle you referred to me as an old timer and one thing that most (adults) learn as they age

“It’s better to be thought as a fool than to open ones mouth and remove all doubt”

My daughter just texted me and said Dad I am on Bowsite can’t sleep, I seriously think this Doofle person is a lot younger than me and just messing with people!

My local hunting time increased after retiring. But I became more picky. If it was raining I didn’t go out like I would have before if I only had a day or two. I’ve still been doing an out of state hunt pretty much every year. I’m starting to take advantage of all the points in different states that I’ve built up the last couple decades.

Not how much a person hunts but how much he enjoys it when he's out there. Hard to truly enjoy it if there is problems at home. Having said that, hunting and retirement go hand in hand and it's better every year as there is zero pressure just the great outdoors to enjoy when you want and how you want. Relax and enjoy. Simplify. Now you have time on your side.

I had a private message from Doofle & it said what you selling ass cracker.. Hmmmm, someone has "real" problems.

Lol I went and checked our PM unless the first message I sent doesn’t show up which I am sure all I sent you are there under archived messages and If me telling you twice to quit stirring shit is cursing you out multiple times after your trolling here well Snowflake all I can say is I hope you find your safe place wherever that is?

"Whitetailbob"- Congrats on a nice buck!

OP after reading this thread the obvious take aways are that you have plenty of money, an impressive "portfolio" and a younger wife who makes 40K a year? Why the need to compare yourself to others here and display your life on the inter web in a sort of humble brag way? Sometimes there's a thing as "too much information" aka TMI.

The positive take aways are the contributors who have real life experiences and advice which only confirms to live each day as it's your last.

I hope all of the "amenities" you possess make you happy for as long as you need.

JMHO.