WARNING- Cabelas Card Holders

General Topic

I have a Cabelas Card and Capital One is the bank over their credit cards. On Wednesday, May 22, I had six fraudulent purchases from Sams Club in St. Louis, Missouri from 5:17 pm to 5:22 pm totaling $1499.91. I called Capital One at 10 pm. I live in North Central West Virginia. I contacted Capital One on Wednesday when the sales were still pending and today, Friday, May 24 I checked my account and the sales went to pending to posted transactions. I did call Capital One and they did start an investigation that will take 30 to 90 days to complete. Do the math. There is no way I can travel from St. Louis, Missouri to North Central West Virginia in 5 hours. I am still responsible according to Capital One for the 1499.91 while the investigation is going on. I will have to come up with the 1499.91 to pay the bill when I receive the statement. Capital One even let the fraudulent charges exceed my credit limits by 370 dollars. Do not let this mess happen to you. Find a credit card that will protect you better. Your local bank will probably have a better card that protects you better than Cabelas. Do not do like me and let the points draw you in. Most credit card companies want you to notify them when you take a long trip. Missouri is 860 miles away. I always notified Cabelas when I took my trip to Colorado in September.

Don`t pay the $1499.91....what are they going to do....cancel the card....lmao The charge is in dispute and wasn`t made by you....if it was a debit card you would be screwed but not a credit card.

What? That’s bizarre. My credit card instantly charges it back, apologizes for the hassle and that’s that. I would tell capital one to shove it up their ass and cancel the card.

I’ve had similar issues with my Cabelas/capital one card and been very pleased with the resolutions. Obviously an inconvenience, but not directly their fault I don’t think. Seems kinda odd.

—Jim

When it used to be Worlds Foremost Bank I had a bunch of fraudulent charges and they removed them with one phone call. Capital One scares the crap out of me. I was wondering what would happen and this is just what I thought.

So many better options out there than a Cabela's card. Don't know why anyone would have one.

Hope everything works out for you, spyder.

Another place where Bass Pro has ruined Cabelas. We had that issue twice when it was a Cabelas Visa and I have been looking into the best rewards card to replace the stupid MasterCard they replaced it with. Thanks for giving me one more reason to dump it. Shame too. I'm one of the original cardholders, 1995 I believe. In 2005 Cabelas sent me a pocket knife to say thanks for being a loyal 10 year cardholder. Now its gone to the pot like the bargain barn and so much of Cabelas. Such a shame!

Had fraudulent charges on my Scheels Visa last month. They were super nice and told me not to pay while they sorted it out. That has been completed and everything is good. I think it started at Lancaster Archery because I got a letter saying their credit card handler was skimming info. I am definitely not bashing Lancaster because they were up front with me. They got burned by some jerk or jerks along the way. Also not sticking up for Cabelas but I don’t really think it’s their fault. Crap happens. Too many crooks out there.

I agree that it is not Cabelas or Capital One's fault DIRECTLY. Capital One needs to have a better way protecting their customers instead of saying you are responsible for the money until we sort this out. How many working class people have 1500 dollars to pay the bill until it is worked out? Under the old bank they would contact you immediately when a purchase was flagged. I forgot to contact Cabelas when I went to Colorado one year and the first gas purchase I made west of the Mississippi my wife was contacted. Now your credit card can be maxed out and then you are notified and are responsible for paying the debt. I can now understand why crooks pick Capital One to fraud their customers.

Mastercard is different from Visa. It isn't Capital One. They are just the processing company. I recently had a problem with a Capitol One Visa and something I ordered online from a scam company that was never delivered. Capital One negotiated with Visa on my behalf and the charges were refunded back to my card.

Whenever a purchase is made on my Capital One Visa I get an instant notification from Capital One. I can then accept or dispute. Don't get that from Capital One Mastercard (Cabelas card)

I kissed the Cabelas card goodbye a few years ago and it was one of the best decisions I’ve made. The card I have now accrues points over 2X as quick.

Ditch the Cabelas card, find a travel card with a good sign-on bonus, and don’t look back.

When I used my Cabelas visa I was very pleased. Bought a lot of guns, ammo and a tent with the points. Three times I was contacted by them asking if I had just charge an item. Once they said a dinner in San Francisco had been charged the night before and then a hotel room in Tokyo had been charged and ask if it was mine. I said no and it was removed and two times a new card was issued. Since the change we have not used the card and will cancel it. Pity it had to change.

are people saying a sporting goods company is influencing the policies of a lending / credit institution. Any brand could be on the card, it is Cap1 that is the issue not the brand.

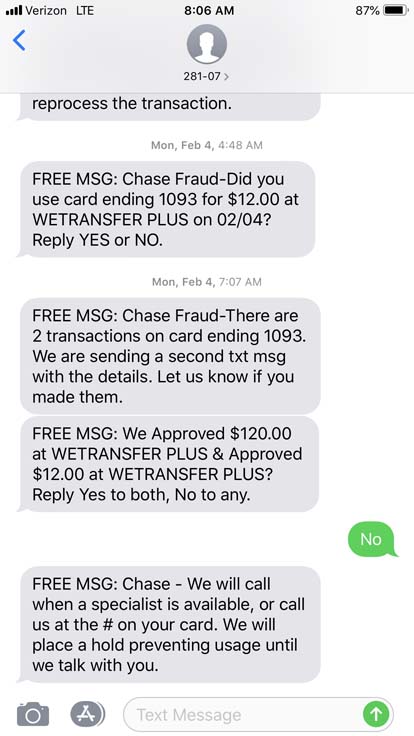

Had issues with a Chase MC while traveling in MX back in Jan. Three fake charges were still in pending status when I reported them as fraudulent, and as a result Chase never allowed the charges to be authorized. No doubt there are different security procedures depending on the circumstances of the charge, card-present vs card-not-present, your spending history, and lots of other factors. Doubt if it matters the specific issuing bank or store name on the card. What saved me was having instant notifications set up to text me when any charge is attempted above a certain dollar threshold.

Bou, Cabelas “choose” to outsource their card to Capital One, who never had stellar customer service, I’m sure the decision was monetary.

If I switch to cheaper Pepperoni and give my customers an inferior product, I’m at fault. Cabelas/Bass Pro is at fault. They could have “choose” a cc company with a better track record of customer service.

American Express Card .... don’t leave home without it.

With them, fraud is never your fault. In fact so good, that we used the card for a $6,000 auto repair, and the real work was never performed and impossible to know until afterward. Then the guy closes his shop stiffing tens of thousands from other folks too. Anyway, Amex credited our card immediately then investigated, and they took the hit. They take responsibility for vendors that they authorize to accept their card.

With my card it`s the other way around....they track places that you have used the card in the past and if a charge pops up out of the normal places they shut the damn thing off. Sometimes it makes me mad but they are just protecting themselves.

Franklin is should make you mad it is a big problem and they are in business to offer a service not to protect themselves.

Question, how do you guys find out about these fraud charges? Do you guys check your credit card charges evetyday?

pointingdogs: usually as below with a text alert. It's rare that the bank wouldn't detect the fraud long before I'd ever notice it on my statement. Depends on how you have alerts set up for your account though.

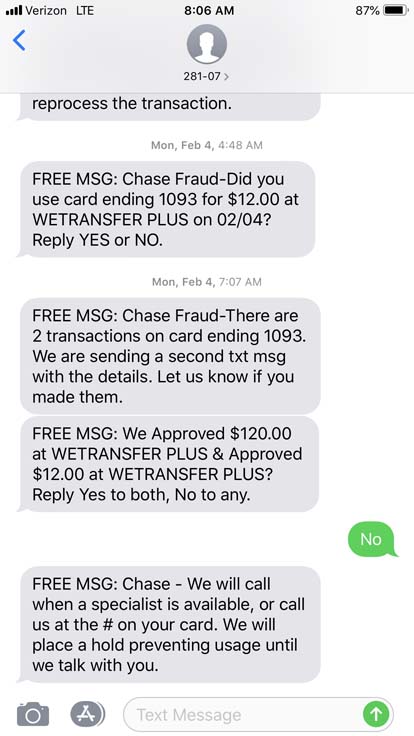

Bad news is that as soon as you reply "NO" as I did in the example below, the card gets permanently locked.

Aint Capital One the company with the spokesman on their TV ads who said if Trump got elected he was moving to Canada? And he's still here? LoL. That alone should be enough to dump that company. No thanks.

I filed one dispute my Alaska Airlines card which is a Bank of America Visa. They charge of $1000 was removed from my account until the dispute was resolved. Eventually they sent me a letter saying sorry the transaction was eliminated permanently. I’ve had nothing but good experiences with them including flying up to moose and caribou hunt for free and getting my partner a companion fare if $100.

I have a card canceled once to twice each year due to fraud. It’s a PIA but better than the alternative.

Spent the last two weeks in Scotland with my wife. Used a Visa card a bunch with many charges over $100. Yesterday, at the very end of the trip, we had two charges small to a Walmart in Vegas and one to an online music store. Charges were identified as fraud and I got the emails and texts when we landed.

I hold a Delta AMEX, a BofA Alaska Visa and a Chase United Visa and all companies are excellent about identifying fraud within minutes.

Under no circumstances would I pay that bill while it is being disputed.

You should also start a paper trail to protect yourself by contacting your local authorities to report fraudulent charges on your card and you should also contact the local authorities in St. Louis. Knowing the specific times that these charges were placed on your card video surveillance should show who the perps are.

Documentation is your friend

I would absolutely not pay for bogus charges while they investigated. If they told me that, I would just tell them to cancel the card that minute and would not pay them a dime of that money.

I had a tester charge of couple dollars hit my AMEX. I got a phone call from a CS rep, he explained what the charge was and that he would issue a new card and transfer any monthly charges to new card number. He also over nighted the new card because I was traveling in a couple days. Of the service isn’t top of the line I would cancel the account.

Capital One Sucks and Cabelas has gone way south.