Contributors to this thread:

I made the decision to retire the end of July (will be turning 55). I am very excited about it and want to make sure I keep busy. I am a hobby woodworker and have a number of projects lined up to do for family and friends.

As far as hunting, I plan on doing as much as I can. So far I have a Sept 2021 WY elk hunt, Oct 2022 CO Mulie deer hunt (providing I draw), Nov 2022 IA Whitetail Hunt, and a 2023 Oct BC moose hunt all lined up.

Also my wife (Who is already retired) and I will be moving to our home in Sheridan WY full time over the next few years. We plan to travel some once the Rona settles down. Since we will be in WY, I may take up fishing again as I hear it’s pretty good there.

My question is for those who have already retired, what keeps you busy and fills your days?

Thanks for any suggestions. . . Rob

Congrats on your retirement! Iij am far and away from my last day on the job but if you are a hobby wood worker I would give elmont Bingham a call, and start building recurves and long bows. You can spend alot of time building forms and curing ovens just to get started. There is alot to learn and it's very satisfying to build one from start to finish.

It seems that I’m way busier now than I was when I was working.......the only difference now is there’s no time constraints to do the things I want to do or see. It’s true freedom!

Congrats and enjoy life.

Just as Bohntr said I am busier now than before I retired but, really enjoying life. I've been retired 15 years now (went at 55). Had multiple out of state hunts, elk, bear, antelope, hog, sheep in Texas. We live on a farm so there is always lots to do there. I've even broke another horse since I retired. Added on to the house, there is never any boredom. Most of all my wife got cancer 7 years ago and I've been here to help her. Best of all this last summer we finally got the cancer turned around with imuno therapy. Retire and enjoy life while you can. No one knows your expiration date so go for everything you can.

I have seven working days left myself. A little intimidating, a lot exciting. Our house build in WY should be finished mid-March... then the move from Missouri. Oh Gawd, I hate moving! ??

Congrats on the retirement! I'm a couple years out yet.

I'm retired, and active in a local club - 3D trail maintenance and set-up, secretary, ham and turkey shoots, even manage to get some shooting in ;-) Have tied a few flies, fished some, reloaded some rifle rounds, made a few arrows. My 'hobbies' keep me busy but with time for a nap now and then.

Rob, as much as we love our hunting, it is important that one has some other interests to keep one busy. Seems like you have that figured out with the wood working so keep that up for sure. All of this keeps the gray matter stimulated. Once established in Wyoming , you can join a few hunting related organizations or others, and help in their interests and goals. But continue to "stop and smell the roses", as you and your wife have earned it. my best, Paul , retired since 2001 but not from life.

Rob,

Congrats on your retirement and your upcoming move. It sounds like you're already off to a good start. I've been retired for 13 years and have never lacked things to keep me busy. One of my first projects was I restored an old Jeep CJ that was my Father's. It was my first vehicle restoration. I did everything, myself, in my garage. I learned a ton over those 2 years, and I'm quite pleased with the results. I also learned that I didn't want a steady diet of that type of work.

I also learned how to trade stocks. That's become a daily hobby for me. I've recruited 3 friends to join me. Every trading day, we text each other, sharing investing ideas, information, and our specific trades. At the end of the day, we each post our daily tallies. It's become a friendly competition that we all enjoy.

As a Colorado native, I've always done a lot of fly fishing. Since my retirement, I've discovered the world of salt water fishing, which has opened a whole new box of experiences for me. I bought a boat that I store in Florida, and the wife and I spend at least 5-6 weeks a year down there. I look forward to those trips as much as any hunting trips.

Overall, retirement has been a blessing for me and my wife. The beauty of it is you can do as much or as little as you want every day. There's no demanding schedules or obligations. Each day is a blank canvass that you can paint as you wish. You're going to love it.

Matt

Retired also and always something to do. We have a 4 acre farm with lots of animals. I always wonder how I kept up with everything when I was working. Definitely remember to smell the roses!

Congratulations, best thing since pockets! Enjoy a healthy retirement!

I'm 64, retired 4 years now. There is always something to do.

My wife is a HS principal and will retire July 1st. Can't wait to spend more time with her.

Ice fishing, open water fishing, spring turkey, golf, yard work, we installed an in ground pool last year, enjoying our granddaughters, bow hunting.. Some days just have another mug of coffee and sit outside and relax.

It won't take long for you to figure it out.

Doesn’t matter what you do as long as you have a purpose, a mission, and the power to accomplish that mission.

I will have been retired 2 years this may. These last 2 years have gone by faster than any 2 years in my life. I've done multiple out of state hunts and I have 4 planned for this fall. I also spent a couple weeks last spring scouting in Iowa and Kansas and plan to again this spring. I love to flyfish and tie flies. I live on 60 mostly wooded acres and have a few small food plots that keep me busy. I burn wood so there's always firewood to cut, split, stack and haul. My second biggest passion after hunting is old muscle cars. I have a collection of 3 Chevelle Super Sports and a Malibu so working on them and doing restorations keeps me extremely busy. I do everything myself. I also have a Harley, several boats and an airplane. Between all the toys, my house and my girlfriend's house there's always something to fix. Like everybody else, I'm busier now than ever. One of the nicest things since retirement is now I have time to mow my lawn in the daylight!

Congratulations, and welcome to "your world" now.

Seven years in and loving life. As others have said, there is too much to do and not enough time. I volunteer on three Boards, manage two big fisheries (as a volunteer), organize kids and wounded veterans fishing events. Almost every day we work out, hike, or bike. We hunt and fish whenever we want, as much as we want. We take off for a month at a time in the camper and fish/hike/bike across several states.

The three most important factors, IMO, are to be financially secure enough to live YOUR lifestyle as you wish, and healthy enough to enjoy the important things, and have interests and activities you love outside of your work. Too many people I know retired lacking one or more of those critical elements, and are borderline miserable.

Congrats!

I retired at 51 in 2011. The wife has a fantastic job working from home but might start slowing down. One thing I learned is to pace yourself. Don't feel like you have to be doing something every minute. It's also a lot easier to plan ahead as you're no longer constrained or distracted by a job. Keep in mind once you retire, mama will want to do more things too. You'll want to keep her happy and learn to compromise.

Great thread here fellas...I have been teaching for 27 yrs and am 52 years young now! Definitely looking forward to planning that exit...Looking to retire between 55-60 for sure. These middle years kids aren’t getting any easier to deal with that’s for sure! Like to work some type of part time gig that allows me to hunt more in the fall! Glad to hear that many of u r still living your best life in your retirement years!

I'm retired. It seems I'm busier than when I worked, but the truth is it just takes way longer to get stuff done. For one, we're usually older and slower than we were. Two, we have time, so we take the time. And three, we often forget what we went to do and end up doing something completely different so the original job is still not finished.

And the major pitfall for most "early" retirees is a lack of a realistic financial outlook.

Stix, excellent schedule....

After 26 yrs USN retired in '92. Worked 3 more as a maintenance director for Adak School District. In '99 we bought a couple hundred acres here in MT. The ranch is what keeps me alive. Fed the birds (sharptails) this am. About 80 so far.

You have to keep busy and a regular exercise program is very important. Can't beat a staircase when winter sets in.

Hats off to all of you who have that "smell the roses" outlook and are as busy as ever. I am within 5 yrs and my biggest concern will be to figure out how to keep a wife happy (one who doesn't hunt) with all the extra hunting trips I hope I am able to do!

I am about 18 months behind you, except I already moved to WY and telework right down the road from you

Yup the fishing here got me back to both fishing and take up fly fishing. There's some great places in the Bighorns right up the road from You

I retired from the Army in 2010 at age 40. Worked an additional 3 years as a JROTC instructor in South Dakota before becoming a full-time college student. Finished school in December 2020 and picked up a regular job at the Menards distribution center (DC) to get out of the house a bit. That said, I juggle improvements to our property, book writing, and outdoor pursuits to fill my days, when I am not tinkering with conveyable shipping at the DC. Best of luck to you in retirement.

I'm 64 and I retired last August, just in time for hunting season. Our season ends at the end of Dec so since then I've been trying to get my bearings. Being task oriented, I'm finding that I have to have something to do, I have to have a plan, or I'm kind of lost. Not too good at sitting around. This china virus doesn't help as everything is limited. I've got my list of home projects to do and will be turkey hunting and fishing in a few months. I also see (some) of my grandkids every day which is awesome. My buddy who retired years back assures me that I'll figure it out. One thing I don't miss is the daily traffic grind. That second cup of coffee in the morning is great.

I retired three days before I turned 61. Had our financial situation in good shape. It’s been a fast nine years. In my case, I’ve found that I don’t have to be busy 16 hours every day. I pace myself, practice with my bow an hour, read a book, have lunch, take a nap, load some ammo, etc. I do several small tasks a day, but take my time. And I hunt a lot. Best job I’ve ever had. I would add, be sure your financial situation is very solid. I can’t imagine running out of $$ in my 70s and having to go back to work.

I retired at 59 this pass April. My buddies got me started on fly fishing and love it. Also been doing lots of pheasant hunting. I shoot my bow throughout the week and go to our clubs 3D leagues once a week. A lot of hunting opportunities in WY. I just got a part-time job this past week at Sportsman Warehouse. I make a little play money and get the employee discount. I also exercise 4-5 times a week to stay in top shape which I think is important. Life is good!

Congratulations on your decision and I wish you the best.

Your question was interesting to me in that you foresee more hunting. I did also, but for me it didn't work out that way. In fact, we planned on moving closer to the grandchildren, but that hasn't worked out either. I'm seventy-two and retired four years. So where has the time gone and what am I doing. I would say that I've re-evaluated my previous plans and found that a personal preference for satisfying experiences has dominated my day to day decisions. Due to my decision to take time to get healthier, I've enjoyed the cycling and workouts that have improved my ability to perform physically. With slightly over eight hundred miles last year and eighty something on the calendar for this year, I want to keep going. Sure I get the occasional ache and pain, but overall I would say I'm healthier now than I have been in the last fifteen years. My work as a mechanic in a large facility wore my body down to a much greater degree than I had realized. IMHO, for you to retire at 55 is a headstart on being able to reach a level of physical fitness to avoid common maladies of old age, do it.

I still love to hunt when I can, but I'm not anxious, nor regret when I choose not to. I've gotten heavily into an online ministry where I communicate with other people, sometimes for hours. Where while working I had calluse's on my hands and feet, I've No-Crack "creamed" those away, and now "fingerdance across my keyboard." I still do an occasional repair or emergency project requiring my mechanical skills, but the responsiblity to maintain datails that were particular to the job have receeded way behind my daily thoughts. Hobbies like archery, guns, fabricating knotted trinkets from cord and reading are choices seemingly always available to me. As with a young person, some things I still take for granted.

I like to cook and bake more often, which has endeared me to my wife, more so than ever before. Retirement for both of us has brought us closer together and a shared purpose for daily activities. Alone, was the first thing God said was not good for man, and a valid consideration for any man today. It is she that reminds me that not everyone gets a life of retirement.

Please yourself and find peace, before you rest from this world forever.

Retirement isn't everything is cracked up to be. It's WAY better! Your woodworking hobby is perfect. Matter of fact, I'm just in on lunch break from my workshop was I type this. I'm over 12+ years into this gig now after retiring at 53 and haven't regretted my decision for a single day and have yet to be bored. Congratulations. You'll do fine.

Congrats on your retirement decision.

I am enjoying this thread. I am hoping to go dec of next year at 50. Life is to short.

Haven't decided if I want to start a second career or just get a job to keep me busy.

Hoping to move to Florida, so that will be enough to keep me busy just learning the area etc. My wife is going to have to work much longer then me, so I will have plenty of free time.

For the people retiring in their 50s, do you have pensions or did you just invest well and do well financially?

I’m 53 and will be retiring in the next 2-3 years. I have both a pension an annuity.

grey ghost-

The ocean is an amazing body of water with unlimited possibilities and species to chase and catch! Idk what id do if I didn’t live close to the ocean. Spring amd summer it’s my escape!

When you retire a ‘Day Clock’ is a must because you forget what day it is

I am fortunate that I have pension and other savings.

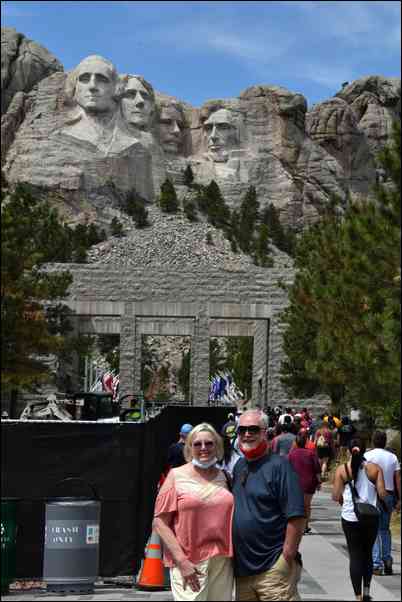

Retired at 60 (19 years ago now). I do plenty of bowhunting & usually 1 or 2 out of state hunts. I returned to competing & "try" to make the bigger state shoots + NFAA National, sectional events. Not big on 3-Ds but do a few with my son & his friends + my G-kids that shoot. We have 15 G-kids & always support them in their sports (baseball, football & basketball) THAT gets hectic at times. I always set time back for my awesome wife who "never" say's one word about my archery/bowhunting with something "she" enjoys. Last year it was Yellowstone 3 days, Mt Rushmore area 2 days & several other spots in the 8 days. She is very big into photography. She just returned from Florida from a getaway with her gal pals in photography. Family always comes first & then her & I make our fun plans. Summer is lots of yard care with many floweres & feeding of critters (We have a huge timber adjoining our property & tons of birds, Squirrells, Coon, Deer, Turkey & others). We have a busy life but fullfilling.

Ryan, no pension for me. I invested well, lived below my means, tracked and planned budgeting for a year and a half, paid off both houses, and created a "pension" for myself with an annuity from some of my investments. Now with the annuity and Social Security I'm actually "earning" more than we spend, putting money back into investments every quarter and still growing the nest egg.

Thanks for all the great replies and encouragement!

Between my woodworking and photography hobbies, I think that will fill in the time between hunting, fishing, and travel. As the song say, “Hunt’n, Fish’n, and Love’n Every Day”! Black coffee in the morning, dark whiskey in the evening :)

Yes my wife and I are very fortunate that we lived within our means and saved as much as possible for 30+ years while raising two great kids. We both have pensions as well, which I know many don’t these days. We are very blessed.

The subject of retirement has been on my mind for a while. I will be 67 in April. I was the first in our engineering department to be asked back to the plant after working from home for a month. I think I have enough money to retire now but I feel alive when I help others do their job. My wife and my closest friends are all retired. That doesn't make it easier to show up to work each day. Maybe I will retire soon but for now I feel I am doing what is best for me, family and company in that order. Do what is best for you.

Jaq, in my opinion, hit it on the head. Living below your means is the key. I turned 55 last August and was planning on leaving this March, after 30 years with the company. Then, "work from home" became a thing and it gave me an immense boost. Leaving this March would've been doable, as long as everything went right. Staying for another 1-4 years will only help matters a ton. For the first time in 5 years, I actually love my job again and plan to stay for another year, at least. On the outside, I will retire at 59, when my wife does. It most likely will be somewhere in between 1-4 years. Be adverse to debt, pay everything off ASAP and/or don't go into debt if not necessary. Fund the 401k/IRA/Roth etc and keep funding them. Don't stop and don't borrow against it. And Cnelk. I need a day clock for working from home, too, lol.

Some folks way underestimate how much they will actually spend in retirement, plus not factoring-in price increases in everything going forward. Then they accept that they have to go back to work, but their old job isn't there anymore so they end up working at Home Depot for $15 an hour just to make ends meet.

That happened to my sister, who retired early just because I did. She didn't have anything invested and expected to live on her reduced state pension. Now her new job requires a commute of 55 miles each way, and doesn't pay as much as what she left. Poor planning, and she wouldn't listen to me.

Running a budget is key. Start as early as possible- as in first job as a teen... Yes, you need to know how much money yo will need in retirement, and the best way is to run a monthly budget for 30 plus years. I know it sounds simple, but many many do not do it. Do yourself a favor, track all spending and learn/know how much you spend on everything in your life. It blows my mind how many people do not run a home budget.

Wife and I have been retired now for almost 2 years now. She became a travel agent, so we’ve been traveling a lot, even with Covid crap. I find myself busier than ever. All the old ladies in the community, friends of my wife’s aunt, are calling all the time with odd jobs. Good part, I can pick and choose. Have fun, lose track of what day it is and enjoy what you worked for.

Wife is retiring January 1 2022, I will be June 4, 2022. We both have excellent pension, and health benefits. Small annuity's as well. House loan a year and half from payoff. then debt free.

Wife and I have been retired now for almost 2 years now. She became a travel agent, so we’ve been traveling a lot, even with Covid crap. I find myself busier than ever. All the old ladies in the community, friends of my wife’s aunt, are calling all the time with odd jobs. Good part, I can pick and choose. Have fun, lose track of what day it is and enjoy what you worked for.

I'd like to get to retire but I doubt its in the cards for me. With the socialists war on fiscal and financial responsibility, I'll likely have to continue working to pay for student loan debt, past and the next few wars, spending on all political pet projects for socialists and republican deep staters, and the retirement benefits of state and local blue state retirees.

Make sure you understand how your pension is funded and if it can be raided. Underfunded pensions are the next financial shoe to drop as baby boomers bail out in the next 10 years.

I get a govt retirement check every month. I use to jokingly say it might go away some day. Now....the joke might end up being on me if/when it does indeed go away.

Teachable moment I always told the kids.....never, ever count on someone else to do something for you that you should be doing for yourself.

To me, there is a big difference between retiring and just retiring from your present job. If you’re working , your not retired. Even if it’s “just for fun”.

for you guys retiring early,, what are you doing for health insurance?? it is costing me around $900 per month till i hit medicare,,,

Rob you are going to leave our great state of Vermont!!! Well I don't blame you I retired at 62 with hopes of moving to Wyoming or Montana which the wife and I have had as a plan for many years but as fate would have it our plans have changed at least for the time being.So Congratulations on your upcoming retirement and follow your dreams will miss seeing you on the VT forum as there aren't many on there!! PS. You are hunter i am sure you will not want for things to do!!!

I followed the Obamacare rules and kept my taxable AGI way down by drawing from post-tax investment accounts, so a "Silver" plan from Anthem on the exchange was only about $100 a month for me and my late wife.

I'm retired military so I have Tricare Insurance at less than $50 dollars a month for me and the wife. We also have Delta dental insurance. Once I turn 65 I'll get Tricare for life with no premuim.

Like stated a lot of people retire to soon and aren't financially ready. Financially we have no debt and quite a few pensions. I won't even need to tap into invests and IRA's until I turn 72 when required by law.

Not to worry bigbuck, I’ll still be around for a little while.

Regarding insurance, my company currently pays 75% of my premiums as an employee. As a retiree it drops to 50%. It’s still a chunk of money to pay, but better than nothing.

Hopefully folks do their homework prior to retiring. I have done my own analysis, then compared notes with my Financial Advisor. Thankfully we are on the same page.

Grizzly, your question on health insurance is spot on. I think for my wife and I it was about $1200 a month. Better have that in your plans. To those who asked about pensions, I retired early and have a very good monthly pension. From what I understand, you should be able to take 4% of your savings out and it should not run out. So, if you have a million in saving, you could take $40 grand a year from savings. Add that to pension, SS and other income and that’s what you have, before tax.. FWIW, I can’t fathom retiring with any debt, unless it’s very small and you have a very large savings.

Grizzly, I receive 1150.00 per month until medicare, guaranteed annuity. If I do not retire next year I lose it so I have to go. Plan to be semi retired. I also planned to work a couple more years anyway, but have to leave now. I only need a single plan as my wife has her own plan. I am retiring in the WI retirement system. Number 2 most stable system. WI Govt. tried to raid it years ago and they lost in the courts.

I'm 58, am planning to retire in 2 to 4 years. Best of luck to you Rob in VT!

Luckily after 31 years with IDNR, my insurance is paid for life. Wife’s is about $135 a month. One of the perks for all the crap over the years.

I retired at 58 with a government pension. I also put money away in deferred compensation for over 20 years. I'm drawing off of that now to supplement my pension. It will last beyond when I can start drawing social security. I also get health and dental insurance through my former employer for about $100 per month and will also cover my Part B once I hit Medicare. My house is almost paid off and I have other real estate that's paid off.

I could have retired 10 years ago, but I bought hunting/farm land...and started putting in food plots :-(

My brother retired at 50 and insurance started climbing soon after, putting a squeeze on him. About 5 years in he switched to a health share program. They are not for everyone but he pays right at 300/month and the out of pocket is very low. He has been in this for about 4 years now and has absolutely no complaints. Again they are not for everyone but are worth exploring.

I retired at 50, eleven years ago, debt free. I had 35 yrs in the carpenter trade .I had to wait until I was 55 to get my pension. If I had to do it all over again, I wouldn't change a thing. The last thing I think of, is what am I going to do with my time. If you are active and healthy, bordom will be the last thing on your mind. I don't live a lavish lifestyle, but live very comfortable, by my standards. I have never been one that needs a brand new everything. I don't work at all, except doing things for family and a few close friends. I turn down work left and right. I worked my whole life until retirement without ever being laid-off or collecting any unemployment. Pretty unusual for being in the trades.

Does anyone have experience with changing your state of domicile (residents)? Curious how smoothly (or not) it went for you and if you had any issues with the state that you left regarding income state taxes?

I retired from Air Force then stayed in Utah for 5 more years. When I got the job in WY and moved it was pretty easy. The biggest hassle was getting new plates for my trailers and vehicles. Had to have the Sheriff come out and verify the trailer numbers to get it registered.

I retired at 56 just shy of two years ago and relocated 3500 miles from Alaska to Wyoming. Both states are a no income tax states. We built in Wyoming and, long story, ended up with a higher mortgage than intended which eats into my slush funds. Wifey and I both have a pension or similar incoming funds from 3 different pots plus an investment pot that we pull just a wee bit out of each month. I have subsidized health insurance as a part of my retirement package but still pay a portion, maybe half now versus a quarter when I was working. It's about $550 per month for my wife and I.

For those of us purchasing our own health care plans prior to Medicare eligibility, don’t forget to budget for the deductible, too. My current work plan carries a $5,000 deductible so that’s what I’ve planned for even though it’s likely on the high end and if healthy I won’t reach it.

Rob: I'm in the hills about an hour and a half east of Sheridan. Property taxes are probably low compared to what you are used to paying. You can do a lot of stock up shopping in Billings and avoid annoying sales tax (coming from Alaska I'm not used to it). Vehicle registrations are a PIA, need to redo it every year. Inefficiencies like that suxs for country people that dont live close. Oh yeah, our governor is a Rino that we need to dispose of, that awful witch Lizzard Cheney needs to go too.

LOL at t-roy! Thanks for the warning!

I have a question for you guys that have retired early. Do you give a rat's rear-end if there is anything left when you die to pass to your kids? For some stupid reason, I feel a little bit of responsibility to help them out when I'm gone. Am I stupid?

This spring for me 79 days.

I will be 54, and stuck in the Health insurance debacle also, My pension does not include any form of health insurance. My lovely bride will still be working for a couple of years, so she can carry the insurance for the time being.

I will have to work to provide insurance once she retires, therefore I am job shopping already, and looking for someplace to plugin and work minimal hours for health care.

If I work until I am medicare eligible, I may have a second retirement? we will see how that goes.

I did start a wooden arrow shaft business to fill the retirement hours and income needs, but I think I would be working so hard to make that much income, it would make my hobby too much of a job, and then I would not like my hobby. Therefore, I retire in June and the Mrs, has given me until Jan 1, to find a suitable job.

let the fun begin.

oz

I retired on May 31 of last year at 56. I had 25 years in the Colorado PERA [pension]. During those 25 years, I did not pay into Social Security so I had the opportunity to 'buy SS years' and convert them into my pension. I will take a 'Windfall' in my SS, but I plan on taking that reduced amount when I turn 62 because it will only be a supplement to my pension.

So I took my investments, and bought 5 years, giving me 30 total years in PERA pension. I also get a monthly stipend towards Health Care [40% +/-] for the rest of my life.

I started a handyman business also. Work part time doing stuff for people. According to my taxes, I made more money last year than I did working full time with no stress, no bureaucracy and no whiney people to deal with

There aint nuthin wrong with working after retirement. It keeps you fresh and out of the rocking chair. Hell, even if you go out to your garage/shop and putter, that's still working!

I refuse to let life slip away and say 'Oh Poor Me'. Im gonna stay busy - even if it means working.

My house isnt quite paid off, but I live within my means with no other debt. Fish and hunt whenever I want is awesome.

12yards. I used to think about that but not any longer. They will each get something but not as much I had originally planned. My son gives a lot of his money to causes in Africa and the like. Then never has money. I get it but no my way. My money is not going or their money cause they have mine to help some "poor" individual given everything and won't work their way out. My daughter has wasted a lot and made some bad choices. Grandkids may be surprised though. LOL

Looking at some of the above healthcare costs.....I'm blessed to have Tricare Prime.

I often forget about it but my only real work now is doing a neighbor lady's lawn care and odd jobs in the non-winter months. Been doing that for 4 years. I feel like Forrest Gump.

12 yards, I have something to leave, anything left of retirement or home value will be bonus to them.

I was gifted a large recreational property, I will be passing that on to my kids. I have a plan that if it comes to fruition will pay taxes, insurance, and maintenance on the land for them, so they will have land free and clear, and it will not be a monthly or annual cost to them to maintain. The theory is if they do not live close and cannot use it, it will be there when they can, without expense.

Retirement will help me with the plan to cover future costs, I will start logging it in retirement, and stashing the money for expenses.

We will see how that works, pipe dream as it may be, that is the plan for now. oz

According to some, I've retired several times in my life :) With the last one still holding.

"Do you give a rat's rear-end if there is anything left when you die to pass to your kids?"

My kids likely already make more than I do so I'm not worried about leaving them anything but half my post retirement income will come from my investments and watching those investments go down would not be a good feeling. At least not until I hit 90.

Amen to Cnelk's attitude toward "working" after retirement w his handyman business. In 2021, there is lots and lots of "free money" out there waiting to be had. In today's day and age, many are willing to pay (and pay handsomely) for tasks to be done for them. Handyman skills can provide a good jingle in your pocket (or more) if you have such skills. If you don't have specific skills, there are still many things people are more than willing to pay for rather than do themselves. And, IMO, if you enjoy what you do, your really are not working, you are doing what you enjoy and getting paid for it.

I was with Liberty Healthshare for a year after my doctor recommended it. Was $200 a month with a very low "deductible". Problem was, some faceless panel somewhere decides what is eligible for sharing, and none of my medical bills during that year qualified. No reason was ever given. My doctor apologized to me after that, said she had to fight with them for qualifying payments for others, taking months and many resubmissions.

As for heirs - I have one snowflake daughter to whom I plan to leave my mountain place if I don't need that money. Otherwise, my piggy bank is mine to do with as I please. I'm self-made had a job since I was 10, got no inheritance. So I figure I earned every nickel.

midwest, yes, my kid's success will definitely factor in. My kids are just starting to enter the working world (real life) off the dad and mom family teet.

My plan is to leave money to my two kids. They are both respectful hard working adults. Ideally we can gift them money while we are still alive to make their lives a little easier and to help with grand kids when they have them.

Yes, I plan to leave a lot to our two kids. They’re both educated, and doing well. But I can, so I will leave them money, a lot actually. And we give them some annually now.

As of this morning's check on Ancestry dot com, I don't have any children. I have a niece and nephew that are liberals, so, I just plan to spend it all!

Uncle Steve H., is that you? Lol

The keys to an early retirement are to have lived with just one wife and one house.

Rich people stay rich by living like they are broke. Broke people stay broke by living like they are rich.

We have no kids, the nieces and nephews won't get anything so we've each decided to give our 50% to charities/organizations of our choosing and that's spelled out in our trust. Mine share of whatever's left is going to hunting/conservation organizations I know well such as Nevada Bighorns Unlimited and Wild Sheep Foundation. Personal property is written in to a supplementary sheet in the trust and some friends and relatives will get some nice stuff.

That said, my dad passed in 2016 and my mom in 2019. After my dad moved on, my mom often talked about how proud she was that they were able to leave their four kids some money.

"The keys to an early retirement are to have lived with just one wife and one house.

Rich people stay rich by living like they are broke. Broke people stay broke by living like they are rich."

^...a lot of truth right there....

WRT to healthcare costs....me and mama use a Health Benefits Card to save on taxes. As one gets older and make more Doc/Med visits....an HBC is a pretty good t0ol to save some money.

Including a legacy for my kids was a big part of my planning. Part of my overall strategy is to have the bulk of our assets available for our kids and grandkids. We live a simple but very comfortable life.

Hopefully our kids and grandkids will get some decent sizes chunk of money, but that's not a goal, just a requirement for not knowing how long we will live. Our goal is to not worry about running out. They can have what's left

One of the best pieces of advice my dad ever gave to me: One's financial success is not dependent on how much money you make but, rather, on how much you spend. I live my life accordingly.

One other handy tip - marry someone later in life with no debt, a fat pension and big IRA. Don't ask me how I know this.

Congratulations on your retirement Rob! Funny you asked as I retired....today! Just entered my very last Out of Office notice in my email. My retirement gift to myself is an Alaskan caribou and bear hunt this September. Also booked for Kodiak Island in 2022. Going on my first antelope hunt to Wyoming next year as well. I’ve got a million things to keep me busy...my hunting club is close by and I’m down there all the time year round. I turkey hunt all spring too and am headed to the Midwest in April to attempt to kill the slam. I enjoy yard work and plan on helping out at the church all I can as well as going on mission trips. I’m a fitness fanatic and that takes up lots of time too. How did I ever find time to work!! Lol. Best of luck! Maybe we’ll run into each other in Wyoming. God bless

I don't have any kids either and I'm a little scared to check ancestry.com. My nieces and nephews are liberals/socialists too and I don't really feel like giving them anything at this point. I was divorced once years ago and had to refinance and give up half the equity in my house. I've recovered but my house would have been paid off several years ago. I have a lot of toys that I still enjoy. Not sure what I'll do with everything... Maybe check ancestry.com from my death bed...

I feel absolutely no compulsion to leave anything to my kids. While they are grown, I still help them regularly and in truth they really are not wanting for anything. (I'm sure they would tell a different story!) In reality, unless I live to nearly 100, they will probably get a very sizeable inheritance. My goal is to spend my savings, and I plan to spend heavily in retirement. I have planned to spend heavily until I am about 80, at which point I believe my interest in travel and expensive hunts will likely decline. I don't anticipate living frugally, but I grew up poor (actually lower middle class) and know how to live on very little if necessary. Unless the government somehow confiscates our savings or imposes confiscatory tax rates, I don't foresee financial problems in retirement. This last year has made it rather hard to travel and actually spend as much as I had planned. Bill

One thing to consider as we age and plan our spending.... Today it costs between $7000-10,000 to live in a nursing home. A MONTH. Medicare doesn't pay a penny of that. The women in our lives almost always outlive the men. So unless you want your wife to live in poverty in her old age, might want to think about how you might pay for 2-4 years of nursinf home care if it is necessary.

I managed my mom's estate as it burned through $450,000 during her nursing home stay, before she died, basically when every penny was gone. In some states, the children are responsible for those bills after mom or dad's money is gone. Look up "filial responsibility" for a real eye-opener.

I serve as Chief of Security at our church, on occasion I teach defensive hangunning to victims of assault and rape, I follow my wife's orders(oops wasn't supposed to type that out loud), chores around the "farmette," take walks, ice fishing, regular fishing, bowhunting, target shooting, cooking, leather crafting tabs, learning all I can about foraging, reading, Bible Study, chasing my wife around the house for fun once in awhile, praying, laughing, and counting my blessings. Oh...and a NAP now and then too!

Congrats on your pending retirement Rob in VT!

I'll be 59-1/2 in May. Have seriously considered retirement. But, like t-roy, I want to buy some recreational land. Just been looking for that right piece of ground. Buying land will definitely delay retirement a few years.

We've been working from home since last March and being told this IS the new normal going forward. Because I'm only working from my home office, the desire to retire is not what it was a year ago. My company also began offering part time employment with full health care benefits for a 20 hour/work week minimum.

Interesting topic. My best friend (wife) won't be retiring for several years yet. I feel guilty heading off on adventures without her. How have you retirees handled disparate retirement dates between spouses?

My wife has been retired since Jan 2018. The only issue we have had is me not having as much vacation time as she would like me to have Lol

I had a co-worker retire, same day as his wife retired. His advice: Do NOT retire together. He said with both of them decompressing and learning to be retired, they fought more in 6 weeks than in the rest of their 40+ year marriage.

I love reading everyone's retirement/near retirement experiences. I am 55. My retirement number has always been 67. Until 2020. I am rethinking this target. I am married. My wife is 7 1/2 years older than I am. Neither of us have a pension. I support the health insurance for both. One child left in college. (Which I am not funding!) But my 401K and IRA's are doing very well.

I am the primary wage earner and saver. Currently directing 20% of salary to 401K. (Above the 11% company/mandatory match) So I have my foot on the accelerator. I am very close to the Fidelity retirement predictor in link.

For me when I retire, if I work it won't be because I need to. I have a secure job, making the highest salary of my life. (I like my job, albeit the stress can sometimes be overwhelming) Why would I retire/quit to make less money?

Also have a HSA, which I am trying to hoard (My wife and I have differing philosophies on this!) I am hoping to build this up enough where I can starting buying months of health insurance via COBRA. (Reducing my age number) as I/we will be on the hook for health insurance/Medicare supplements.

House will be paid off before I retire.

As far as kids getting any money, they will get some if we kick the bucket early. IMHO, the basic job of a parent is to ensure your child lives to 18 years old and you teach them the necessary life skills along the way. (Box checked!) The youngest is studying to become an orthodontist. The oldest is a RN married to a chemical engineer. They will survive.

I really like Grey Ghost's idea of getting a fishing boat and fishing the ocean during the winter months!

Keep the experiences coming!

Regarding the age disparity, by the time my gf retires, she may be changing my depends. We're 17 years apart. She seems to enjoy her alone time when I'm gone on hunting trips. Should I be concerned?

This is one of the best threads I’ve seen in ages. A lot of useful and thought-provoking info. I’m retired Army. Like a lot of folks I took a few months off and went back to work — been there for quite a while now and am considering fully retiring in a couple of years. That small taste of retirement was very nice. My wife also has her own professional career which helps considerably with retirement feasibility.

One thing retirement from the Army taught me is that it is a process and not an event. Everything needs to be dealt with prior to cutting off my paycheck and access. Choices are readily available while I’m working up until the day I retire, but far more limited afterward. Right now we’re in the process of reviewing pensions, savings, investments, wills, living wills, trusts, POAs, insurance, etc. Just want to make certain of doing all I can to get the ducks are lined up before pulling the plug.

One thing I do know is if folks move to another state they need to look at the laws as many times the legal documents drawn up in one state are not enforceable if residence is moved to another.

I'm kind of in Midwest's boat, my girlfriend is 14 years younger than me and she'll probably work at least another 15 years. She's been fine with my hunting trips but I'm not sure how things would go if I was gone more. Right now being home is okay because I'm enjoying being at home during the winter and restoring cars. But currently we're enduring a stretch of sub-zero weather and I'm liking it less and less each year. I can see a day when I would like to go south during the winter. I also like the idea of having a boat on the gulf and fishing in the winter. My brother lived in Ft. Myers for several years and I got taste of the fishing and really enjoyed it.

Congrats on your retirement 1 more year I will be 48 and retired. Love how you have a lot of hunts planned. That’s my goal.

As one who makes a living retirement planning, I LOVE seeing the guys and gals here who have successfully made it happen. Especially those who did it on savings and investing. Bravo! Investing is best done like just voting in Chicago, early and often!

My biggest, and perhaps only, regret in my retirement planning is not getting a Roth. I sort of made up for it by dumping a ton into my 401k, but looking back, I wish I would've educated myself years ago. Had I known what they were and how they work, getting one would've been a no-brainer.

Jaq mentions the nursing home drain. We went thru that with our mom. My brother ran her finances. He had to spend down all of her money on things she still owned (new roof, central a/c unit, car repair, etc) before the govt would start paying for the nursing home.

The smartest money that was spent was for an elder-care lawyer when mom had to go into the nursing home. That particular lawyer will keep everyone out of trouble when comes to your parents welfare, their estate and the govt. When mama and me get a little older, we're going to sit down with a financial lawyer or an elder-care lawyer and plan how were want to move our holdings around so the govt or probate doesn't get it at the last minute. As I recall, there is a timeframe of like 5 or 7 years PRIOR to your nursing home days or your demise in which to transfer your holdings to the kids or trust funds and protect it from the govt and/or probate. If you try to hide or shift that money around after that timeframe, the govt can still come back and get you or your elderly parent.

Lesson of the day...get a financial lawyer or an elder-care lawyer to protect your parents and/or you. It's money well spent and removes any legal headaches.

Following along and paying attention ,I’m right on the door step to retirement, 63 yrs old and 43 yrs in the paper mill in Green. Bay ,Our financial guy says I’m all good to go but am still nervous about it We did take out a new life insurance policy that has a rider that some can be used for assisted living care or nursing home and if we don’t use it our kids can get some of the money Wife would work till I turn 65 to cover insurance for now ,Took me 36 yrs to get off night shift and then swing shift, Days of 6:00-2:00 right now aren’t too bad , I’m also a high school official for track and cross country which I really enjoy so that would be my part time job ,Guess I’m just a little scared yet ,so very good to be reading about everyone’s experience and advice Thanks guys

As far as what I do to fill my time , that's never a problem. When I first retired just over 2 yrs ago, I bought a new lab pup. Training him was nearly a full time job in itself for the first year or so, but now we get to reap the rewards. We go pheasant hunting a bunch now and I couldn't ask for a better hunting buddy and pheasant finder. I concentrated only on walleye for the last 25yrs or so, but I also rediscovered trout fishing. I shoot my bow and run my dog basically every day, as well as hunt turkey in the spring, and I live in my camper at elk camp the last week or so of August and all of September elk season. I spend 1-1/2 hrs, six days a week, working out and there's always things that need done both inside and outside the house. It's great to head to the lake or the mountains anytime I want, and let the weather dictate when I go (i.e. the wind), rather than have my work schedule determine when I can, or can't, go.

I have 2 pensions, military and P.O., as well as VA Disability and Social Security. I paid the house and truck off, and went on Medicare the day after my retirement. Since I'm retired military I have Tricare For Life, which covers my Medicare Supplement at no cost. I carried over dental insurance from the P.O., but the premium is only around $30/mo.

Both kids are medical professionals with wonderful careers, so that isn't a concern. They'll get any real estate, along with other assets, and some fairly substantial life insurance payouts.

I retired to be a full time missionary. Fitting in several hobbies is no different now than it was when I worked fulltime for a paycheck. I still get up early every day and put in a full day and the time is flying by. Since this is a hunting forum and one would assume all of the readers here are bow hunters, I would add that if your thing is to go get x,y, and z critters on some cool hunts; you better consider getting serious about it sooner than later. You will run out of health and hunting friends long before you run out of money. And this thought goes to all of you who think you are in supreme shape and health.

+1 on the eldercare attorney. The lookback period is different in every state. In CO it is 5 years. CA is 7, I believe. Also know that many nursing homes won't take Medicaid when all the assets are spent down. Those that do usually have a waiting list for new residents. So good advice to plan ahead for your assets your heirs, and your future should you need nursing home care.

I'm lucky I like my job and have several weeks of vacation per year. When I hit 65, if I decide not to retire right away, I would like my job even more going to work knowing I can walk away anytime I want. :-)

GET A FINANCAL PLANNER EARLY IN LIFE! I retired at 58 and have done some inspection work for past 3 years. Now fully retired because I started with a financial planner 28 years ago. Small pension ,a great 401K, Roth IRA ( took bonuses and invested) . Get a plan and stick to it.

Yes, get a planner early in life. At the very least, better if in addition to, educate yourself, even on the basics. If nothing more, pull up a 401k or roth calculator on line and play around. Compound interest is mindboggling to the uninformed. When I joined the workforce, IRA's were relatively new and the contribution limit was 2 grand a year. Now it is 6k (7k for those over 50). One "trick" to use is, dump all overtime and/or bonuses into the IRA until the limit is met. Of course, to do this a budget is a must. Build your budget on your normal rate of pay and leave OT/bonuses out of it. Too many plan on OT and bonuses for their necessities. This drove me to work many a Saturday early in my career. The work was available and we had a group of guys that would always come in. We also had weekly call out and that was a nice pay week as well. We picked the times of year to play and to work.

Enjoyed this thread so far. Lots of different ways to get there but unless you're a super high income guy the common thread is live below your means and invest as much as you can as early as you can. Love seeing people able to get out in their 50s. That's my goal. I'm 40 this year and been in construction for 20 years. I'm hopeful I can slide out at 50. I make good money and I'm a save. Self employed so it's all on me, no 401k or company matches. I've been paying into retirement accounts since I was 23 and they are really starting to get somewhere.

Don't ask me, I still have FIVE LONG YEARS to work:(

This much I know though, when I do finally retire, I'm going to have my very own coffee mug with my name on it at the local cafe...and the local fish population will come to fear me! Other than that no definitive plans other than just do what I want to do when I want to do it...if my wife says it's "ok"! LOL

I was a large animal veterinarian. My patients were not fond of anything I did with them. After being beaten up for 25 years, I was physically unable to keep going. Fortunately, I had purchased "own occupation" disability insurance all those years. This insurance pays me 2/3 of my income tax free until I am 70.

If you are in a physical job I can't recommend this enough. In my opinion you are more likely to get hurt rather than killed, and it is more important than life insurance. I'm 58 and have been "retired" for 4 years

I know there are many ways to get there, but these were the keys to my journey:

Save early and often. You don’t miss it if you never had it to spend in the first place.

Take advantage of Roth IRAs in addition to regular 401k (or 403b).

Live within your means. It’s ok to splurge once in a while, just not all the time.

Stay healthy. Health issues are expensive!

Try to save a portion of every raise or bonus you get. It pays much more in the end.

Take advantage of any company matches or pre tax incentives they offer.

Try to be debt free a year of two before retirement.

Meet with a professional Financial Advisor early and do annual reviews.

Set up a Will, Power of Attorney, Medical Directives, and a Trust as soon as you can and keep them up to date.

When the time comes, sit back, relax, and enjoy your hard work!

The 19th is my last day of work. 26 years active duty and 6 years as a contractor for the Air Force. My goal is to spend 3 months a year in my wall tent!

As much as I'd like to have my house paid off before I retire, I can't bring myself to put extra money towards a 3% loan when that extra money could be making a much higher return. I'll only have a few years left to pay on the mortgage anyway.

Save early and often. You don’t miss it if you never had it to spend in the first place.- Check (Started an IRA when I was 19 years old, small but it was a 1st step)

Take advantage of Roth IRAs in addition to regular 401k (or 403b). Check- Contributed to traditional and Roth every year since 1986. New employer in 2006 w/401K. Started contributing to leverage company match. (Total 11% between employer/employee)

Live within your means. It’s ok to splurge once in a while, just not all the time. Check?-I live more frugally than my wife. But I fund my non family expenditures via plasma or my side business (Consulting)

Stay healthy. Health issues are expensive! Check- A couple of knee surgeries, but my fitness and health are good.

Try to save a portion of every raise or bonus you get. It pays much more in the end. Check-I increase my personal 401K contributions via diversion of annual step raise to 401K. (I am topped on steps, but at currently @ 20% salary)

Take advantage of any company matches or pre tax incentives they offer. Check-See above

Try to be debt free a year of two before retirement. Check-House will be paid off when I am 62. Truck will be paid off in a year.

Meet with a professional Financial Advisor early and do annual reviews. Check- I have an advisor (Edward Jones). Although the EJ recommended funds have not done as well, he did recommend transferring monies from under performers to tech stocks. (Very good Returns)

Set up a Will, Power of Attorney, Medical Directives, and a Trust as soon as you can and keep them up to date. Fail-Living will is >10 years old. My wife would love to pull the plug as term policy will expire/allow to lapse in 3 years.

When the time comes, sit back, relax, and enjoy your hard work! Relax?- It will take a while to slow down the roller coaster, but I am willing to try!

Can someone explain, in idiot terms, what the benefit of a trust is? I see LOTS of them around here where land is owned by a trust. What are the benefits and drawbacks? I know my Dad looked into one and said it cost more than his trust was worth (most likely an exaggeration)

Say my "net worth" is around $2.5M including real estate, what's the benefit? what's the drawback?

Like a will, a trust will require you to transfer property after death to loved ones. It is called a living trust because it is created while the property owner, or trustor, is alive. It is revocable, as it may be changed during the life of the trustor. The trustor maintains ownership of the property held by the trust while the trustor is alive.

The trust becomes operational at the trustor’s death. Unlike a will, a living trust passes property outside of probate court. There are no court or attorney fees after the trust is established. Your property can be passed immediately and directly to your named beneficiaries.

Will’s must go though probate and can be contested by anyone mentioned within the will. It can be expensive if this occurs.

SBH-- you are basically right on, but I will add a couple of comments. Technically, all must live within/below their means. Take out income (high earners vs low earners). ALL must live at or below their income, no matter the income amount. This is why a budget is crucial/necessary. EVERYONE needs a budget, the only difference is the size of the #'s. If you have been contributing since 23, you are well on your way. Good for you. And a career in construction can/will pay huge dividends. In 2021, people hire people to do LOTS of things... If you have spent your career in construction, you have the skills to work a side gig in retirement, if you want/need. You may be shocked at what people are willing to pay others, to do for them. It seems ridiculous but it is absolutely the truth. My father had no reason to earn anything after closing down his construction business and retiring. However, he did what he wanted to keep active and thoroughly enjoyed it pretty much until his passing at 79. Now, he did not work "hard" in the end, but you would be shocked at what people were willing to pay him to do things that he never considered "work".

My wife and I retired in 2004 and moved to sheridan we raise a big garden and maintain our place spend a lot of time hiking and exploring public lands 69 now but have taken some nice animals 349 elk for example but there is a big learning curve enjoy the ride

Bob H, BOHNTR touched on this quite well (I'm actually impressed Roy!). A Trust keeps you out of probate. A will alone does not. Probate is expensive, public (your assets become known to every snake out there), takes a long time and is a general drag for everyone involved. It's not something you'd want to wish on your worst enemy, let alone a loved one of yours! States have an exemption amount where small estates can avoid probate. If you are over that amount, you NEED a trust. Joint titling of assets will avoid probate, but what if both of you go down in a car accident or something. Better to have a Trust. Also, while a will alone might say who gets what, a Trust will also say HOW they get it. So you can be much more descriptive, and pass assets according to your wishes. Having an orderly trust makes things SOOOOO much easier for your loved ones after you are gone. You can get one done for $1-3000 in most cases. If you are worth any sum of money at all, this is well worth it in most cases.

As said, do a living trust, it'll save your kids a bunch of grief. Also, up here Motor Vehicles are the absolute worst when someone dies; save yourself grief and tell your kids to simply sign over the vehicle title themselves, forging your signature and pre dating it. The DMV won't know your dead and have no idea what your signature looks like.

Bob, great thread. Congrats to you. Good advice from guys above whose opinions and advice on many bowhunting subjects I have learned to value. Seems like avid bowhunters are also goal oriented in other life matters. As for me, l have been retired or at least semi-retired for about 25 years and can say that these can be some of the very best years of your life (bowhunting and otherwise). This thread contains some valuable information. Kind of like retirement 101. Good hunting and fishing in your retirement.....Bob

So essentially a trust is a will but no probate? In our case, everything is held joint and our wills say it all goes to the other one. If we both go together, or are the second one to go, it all goes to our two sons, split equally. Might be worth doing just for their ease.

I always feel like a piece of crap when reading threads with this subject. I like them, however, and appreciate the info. I should have not done the hunting that I have done. Would be much better off now had I been smarter with the money earlier.

Bob H, it goes beyond just that which you mentioned. A trust is far more detailed than a will. In addition to providing an orderly flow for the transition of assets to beneficiaries, it's also a legal entity that owns assets. Structured properly and where necessary, a trust, or trusts, can also offer additional protections and potential to avoid estate taxes too, if applicable. Which is definitely something to keep an eye on right now! At current $11.5 mil exemption amount, estate taxes are not an issue for most people. This high of an exemption, however, is currently VERY unpopular from a political standpoint. It's generally expected that it will be reduced dramatically. If/when this happens, proper estate/trust planning is about to get A LOT more critical for a lot more people.

Don't poo-poo this. If you are worth any money at all you probably should have a trust. Or at least have a discussion with an estate planning attorney. The reasons pro far outweigh the reasons con!

Ned, you invested in adventures and memories. Can't put a price tag on that.

End of March for me. No problem for finding things to do, there still wont be enough time for all I want and like to do.

PLEASE NOTE!!!!!

I'm not trying to be a turd, but there are several items on this thread regarding Wills and Trusts that are just plain WRONG in Missouri, where I practice.

PLEASE PLEASE PLEASE consult an attorney in your state!!!! EVERY state is different. Terminology is different.

I wish I had $100 for every person who came into my office and asked estate and trust questions using terminology and things they learned on the internet that were just WRONG.

PLEASE consult a local attorney familiar with estate law IN YOUR STATE!

Thanks

A thread like this pops up on here every few years and I always enjoy it! Congrats to the OP for his upcoming retirement and best of luck to you. Lots of good info, but like Bake cautions, seek professional advice as often as possible.

I'm 45 and my wife will soon be 43. We both plan to retire at 55 and when we met with an independent Financial Advisor last year he grudingly admitted that we were on track, although he'd like me to work longer. My wife will have a good pension that will max out when she's 53 but she can't start drawing it until she's 55. All I have is my 401k and a boot in the pants when I tell my employer I'm done. Her pension will be our main source of income with my 401k and her 403b as supplements. She's exempt from Social Security and anything I draw from that will be gravy. We plan to leave our 2 kids each with a good sum of money but that is not our priority, meaning we won't skimp in retirement to make sure we have money left to pass on. I'd really rather pass some of it on to them while we are living to see them enjoy it, but I will only do this if they are more or less self sufficient.

We have always lived on less than we've made and several years ago we bought into Dave Ramsey's book "The Total Money Makeover". I'm not a huge "Dave" fan but his common sense, practical method works for paying off debt and saving for the fuure. We were debt free including our house in our mid to late 30's. We still would be debt free if I hadn't decided to buy my own hunting ground last year but that will soon be paid for and eventually left to my son. Of course, every plan is subject to change based on any number of factors, but mainly health/death. I have heart disease and that can change our plans in a heartbeat, literally.

Health insurance will be an obstacle for me in retirement. My wife will have a good plan through her pension and I will be able to be insured through that but it will be expensive. We will have to check out all options when the time comes. I'm not entirely opposed to working some longer to keep good health coverage if it becomes necessary. I don't mind working but getting time off when I want it off will always be an issue. I only hunt WT deer as of now and don't really see myself getting into any other big game but that could change. I will want Oct-Dec off sooner rather than later.

One thing I'll add that hasn't been mentioned is that if you have kids, encourage them early on and often to do well in school so that they can earn scholarships. This can pay off huge dividends for parents and keep your kids for piling up student debt. And no matter what kind GPA or ACT scores the kids have, make them fill out every scholarhip application available to them. It's a pain but again, it can really pay off. Our son is freshman in college this year and as a senior in HS he earned nearly $60K in shcolarships. He basically earned himself a free 4 year education at our local university, minus room and board but we live close and he'll be driving once they acutally start having in person classes again.

Thanks to everyone for sharing what has worked for them. It's always reassuring to see other people succeed in their plans, especially early retirement.

FWIW, wife and I set up a trust three years ago. We have land in several states and significant investments and other assets. The cost of setting up the trust was $5000.

FWIW, wife and I set up a trust three years ago. We have land in several states and significant investments and other assets. The cost of setting up the trust was $5000.

As I said I got out at 64, which was fine for me, but how did so many of you guys retire in your fifties? Seems most of you still raised families and hunted plenty in between too. What's the secret for the guys who still got twenty years left in the workforce?

BC, there’s no secret. Save and invest with discipline! You don’t need home runs, you just need consistency.

We’ve been through this before but any good financial planner can lay this all out for you... take into account what you have now, assess your future retirement and other goals, and tell you exactly how much you need to save and how you should invest to afford the retirement you want. There should not be any guesswork!

Those who are close need to get an app on your phone with a counter. It's really helping me deal with my last days since my "engagement" at work needs assistance on a daily basis.

Tilz: I had a countdown clock on my computer for at least 5 years before hitting the bricks.

I'm just happy to see it will be April in less than 2 months!

BC, save as much as you can and start as early as you can. Pay attention to the fees you are paying on your investments. Also, keep your debt load as low as possible and pay it off as soon as possible. We wasted way too much money on new vehicles early on in our marriage, we’d be that much further along now if we had not done that. Another thing, IMO income doesn’t matter. It’s all about what you do with what you make.

Interesting thread for sure. I retired from a Government job in 2004 then worked as a contractor for the next 12 years before retiring 3/12 years ago. While retirement has been good it took me two good years to be comfortable not working. I loved my job and missed it when I left. Mostly this time of the year when hunting season ends and still cold for regular golf and fishing outings. Leaving for Georgia on Sunday to do a little public land pig hunting to pass the time. If you are busy and have no financial worries it will all work out for sure. Congrats.

I also wonder about those retiring very young (50's??). Unless you are born rich, it seems unlikely an average working man can put enough away to retire in their early 50's. And I do understand it is largely about the lifestyle you want to live in retirement. I am NOT interested in merely existing, but rather want the funds to enjoy retirement.

I do see many use the term retirement differently. Still working part time is not my idea of retirement. I use the term retirement to mean "living off my savings / investments". I am fortunate and like my job, which is not particularly physical, and I am well compensated. Yes, I could retire anytime if I kept my spending in check, and that is a liberating feeling. I get lots of vacation (9-10 weeks) and set my own schedule. This has a big impact on my willingness to keep working.

I will probably work a couple more years, and am definitely looking forward to full time retirement. And unless the market takes a total crap, I should be able to go on all the hunts I desire each year. It also helps that I am still happily married to wife #1.

Bill

Bill,

I was raised middle class in rural Vermont as was my wife. My parents struggled from time to time, so I certainly was not “born rich”. I work for a Life insurance company for 33 years and my wife worked for a Health insurance company for 34 years. We diligently contributed to our 401k’s from the beginning and made sure we increased the % by at least half of any annual raise we received until we were maxing out the contribution. We raised 2 kids and sent them both to college, and are now paying for their weddings. All the while staying fiscally responsible.

We were both fortunate that we have pensions. That combined with our 401ks and eventually social security will allow us to retire very comfortably in our 50s and neither of us plan on starting a second career.

Best of luck to all and keep healthy.

My wife and I are a LOOOOONG way from retirement. We are 34yrs old and have 3 kids. We could have retired in our 50's if we would have lived like dogs. My MIL passed away at age 56 from brain cancer. My wife and I are very much okay with working till 62 if that means we get to go out and eat, take vacations, and spend money doing things we enjoy. Because if you live like a dog and save every dime for retirement, and then die before retirement would be a shitty life IMO. We are going for a balance of both and hoping it works out.

I worked as a land surveyor for 41 years (started when I was 17) and the last 32 years I was a County Surveyor and in charge of zoning and land management in a suburban county of the Twin Cities of MN. My job paid well, actually more than I ever thought I'd make, and I was fortunate that I qualified for my pension at 58, they don't offer that anymore. I could have delayed retirement and got a bigger pension but I was ready to be done. I also have my health insurance paid and they don't offer that anymore either. I put money away in a government 457 deferred comp plan for about 25 years and probably should have put away more.

I never had a financial advisor or a real budget and I probably spent too much money on hobbies, beer, women, credit card interest, etc as well as a couple new trucks but I was determined to enjoy my life. Nobody ever gave me anything and I worked for everything I have. I lived check to check most of my working life and I didn't skimp or pinch pennies if I wanted something.

My house is very modest compared to a lot of people who made a lot less money than me and I lost some equity in a divorce.

Between my pension and withdrawals from my 457 my take home pay is the same as the last year I was working and I feel like I have more money now than when I was working. I did pay off a lot of debt before retiring and I was commuting 100 miles per day which probably cost more than I realized.

I'll start collecting social security before my 457 runs out so my income will stay about the same and my house will be paid off shortly thereafter so that will be another $1100 or so per month I'll have at my disposal.

I didn't plan as well as a lot of the guys that are posting on here but I think I'll be fine. Hopefully I'm not in for any major surprises. I know that life is so much more enjoyable since I don't have to work, don't have to drive 100 miles a day and have so much more time to do what I want. Because of that I'll accept the trade off of possibly having a little less money...

Bill, my wife and I certainly were not born wealthy and we’ve both worked middle income jobs. What we have done is save a minimum of 10% of our income since we started working in our early 20’s. We are now seeing the effects of compounding interest. The thing that makes it “unlikely” for most people to retire early is failure to plan and the mindset that it’s only for rich people or the belief that it simply can’t be done. We have been extremely blest, by God I believe, but we have also be diligent.

We were fortunate enough to both have parents who taught us to save. My parents never had debt my entire life, raised 3 kids and mom didn’t work other than odd jobs. Dad retired at 55 from coal mining with a small pension and lifetime insurance benefits. The insurance has made that possible for them. They are very comfortable but not really wealthy.

I’ll add another thing. My wife and I haven’t skimped on anything. We do what we want, live in a nice but modest house, drive decent enough vehicles, and generally take a couple vacations a year. Last month I was looking at our financial stuff and realized that we had hit a major financial milestone and I sent my wife a text to inform her and congratulate her, then I told her to get back to work;)

Retired at 44. Was in the right place at the right time I guess. That's been a few years ago now.

Still love these seven day weekends. Never get tired of them.

Dell

It's not magic, start investing immediately on first job, any amount, just do it. Increase as you can. Over 30 to 40 years it grows.

Your chosen career matters to, some jobs simply make more than others. That doesn't change the process

Wife and I were both software engineers, I still am for another 18 months. She switched careers to teacher and was home with the kids

We live a good life with family vacations, but in our means. Put 2 sons through college and we are debt free after 30 years of marriage

It can work

Never underestimate the power of compound interest. Become a student of it until you understand its power. Think of it as a snowball rolling down hill. The bigger it gets, the faster it grows. Compound interest should be hammered into grade schoolers. My guess is, they do not cover it at all.

Ya know what? I’ll define my retirement as I see fit. I’d suggest everyone else do the same.

Ha! In public school now they teach "food justice" and "white guilt". No need for financial education because the benevolent government will take care of everyone soon.

Jaq, that’s right! Go Gault

Yea, I shouldn't have got started on public schools. That would morph into a whole different thread. Lots I could say, I probably should keep this somewhat tied to retirement. Yes, everyone's retirement will look somewhat different. What works for one, will be different for another. Personally, I am looking forward to earning a little jingle in my pocket, post retirement- doing whatever. And there is ample opportunity to do so today, if so inclined. Working/earning money is basically a game, IMO, and it is a game I enjoy. I am truly looking forward to earning money, post retirement- on my terms, my schedule ETC. I call it "free money". Maybe "easy money" would be better description.

I retired when I was 51,years now at 66.Three years ago I was talking with my planer about money going over my nest egg.I made a statement about if I had worked longer I would have a lot more, he ask me if I could go back and give up 15 years for more money.I said hell never no.

Ccity65, your generalities show your ignorance. We cover economics, savings and investing, from 4th grade up in our school. If your school does not use a program such as EverFi you should assist them in incorporating one like it. Local banks, and savings are also great resources in schools. Should stress debt is not a good thing.

Turn 62 this Monday. Robin retired last year at 64. I have 30 years in KPERS pension, and practiced what I teach about compound savings from day one, so we are good to go.

Thought I would be pulling the trigger but now that it is here, I am hesitant. I still love teaching, and know I would miss it. Also, the far away hunts I dreamed of seem less desirable now. I enjoy my farm and habitat work more than hunting today. Teaching at a community college has a lot of flexibility so I do get to deer and Turkey hunt plenty.

Robin is putting pressure on me to join her, and I have started to balk about what I was sure I would do. Thanks for this thread as it is helping me sort through some stuff.

Habitat, I was going to go at 63 but they asked me to stay on part time while they looked for my replacement. I worked 20 hours a week for a year and finally retired last August at 64. That year of part time was a great way to come in for an easy landing. Like you, I really enjoyed my work and was hesitant about leaving. On the other hand, in my mid sixties, I was well aware that the clock was ticking.

Now that I'm retired I'm starting to get my feet on the ground and learning to relax and enjoy this new found freedom. I hunted more this past season than ever. All the numbers worked so there is no money problems. (My financial guy told me I could go at 60). If possible maybe you could try the part time route like I did just to ease into it. Once you take the plunge you'll be glad you did. We're not getting any younger.